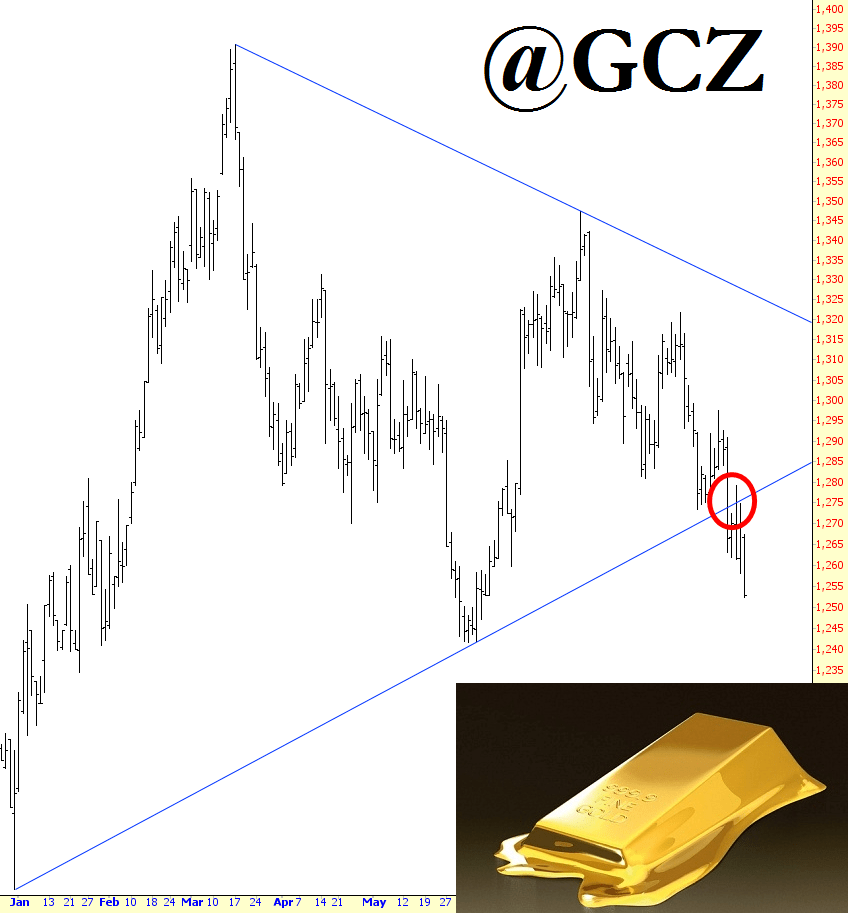

NFTRH has been bullish the USD and bearish the Euro, Canada dollar and Aussie dollar for quite some time now, most often using this simple weekly chart of various currencies. Months ago we noted USD creeping out of its downtrend (green dotted line) and the Euro falling out of its wedge (red dotted line). Back then, sentiment toward the USD was far different than it is today. So this week the Currency segment included some thoughts (and data) on USD and Euro sentiment as well.

Also of note, while the excerpt speculates that a USD reversal could trigger bounces in commodities and precious metals, these items generally remain bearish until proven otherwise. Not the other way around. (more…)