It’s been a remarkably “thin” day on Slope, due to my being 95% occupied with familial duties. This morning, stripped of WiFi, I was totally dependent on a weak cell phone signal, tethered to my laptops, as my only link to the market (you try managing over 100 positions like that!) Mercifully, I was able to get my to my hotel room for a few hours to get a bunch of trades in before the close.

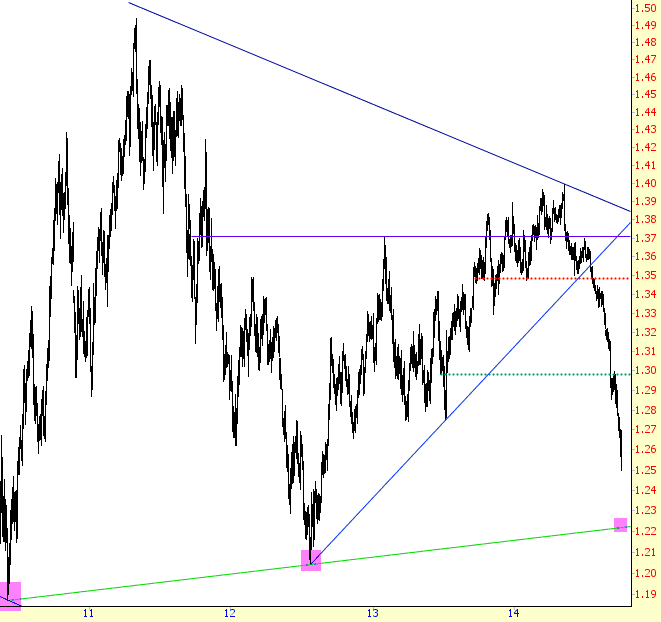

I’ve got a anecdotal post in mind, but it’s going to take me a little while to write it, so I’ll just keep it simple now and share a single chart: the Euro/US Dollar cross rate has been in its own bear market since May 7th (can you imagine equities consistently sinking for that length of time? The Fed would be apoplectic!) With it, just about everything you can hold in your hand – – gold, silver, crude oil, copper – – has been barfing.

Our friends in Gainesville (whose chart and suggestions are actually invaluable during bear markets) have been pointing out the rock-bottom sentiment on the Euro, gold, and silver for weeks now, but frankly, it doesn’t seem to be making a difference. The 96% of survey respondents who have been bearish on silver, frankly, have been quite correct! Being steadfastly contrarian doesn’t necessarily work out. Sometimes the crowd is right.

I’ve been burned enough by going long the Euro recently that I’ve been avoiding it (and I’m thanking my lucky stars that my NUGT trade yesterday was just a day trade, and not something I clung to). Looking at the Euro, it is actually pretty easy from a charting perspective to argue it could plunge to 1.22, about 2.5% lower than present price levels. 2.5% sounds miniscule, but given the vicious free-fall the Euro has been in, that’s some pretty nasty icing on a very distasteful cake.