I hadn’t done any options trading for a while, but a few months ago, I dusted off my options account, put some money into it, and started trading it. The past few weeks have been particularly good to me, with the account up about 100%, but along the way (particularly the most recent week), I left a ton of money on the table.

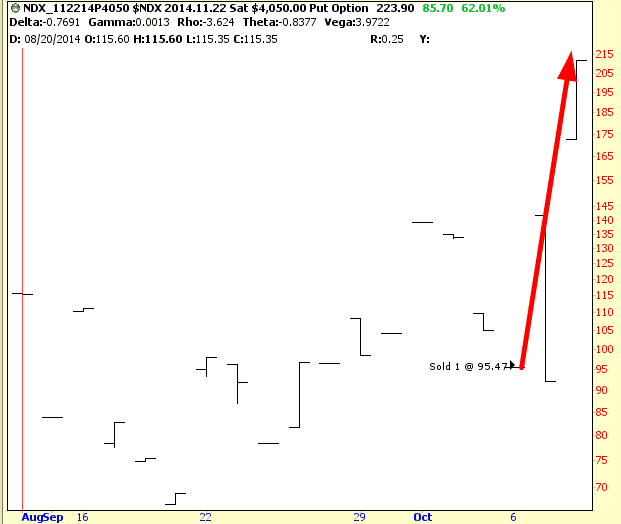

There was one particular issue that left an impression on me: a NASDAQ put. Now, most of my options trading (which is brain-dead simple: buying puts on stocks that I think are going to fall and whose expiration is several months out) is focused on individual issues, not indexes. But on October 3, I decided to buy the $4050 put on the NDX.

Unlike my other options (which are conservative, expiring in January 2015 at the very earliest), I got relatively aggressive with this trade, buying a November expiration. I bought 1 – count ’em – 1 put, but at $105, that was still a $10,500 position.

Now this next point probably sounds really dumb, but it’s the truth – – – it dawned on me that if the index dropped 50 points (which isn’t a lot), the intrinsic value would go up $5,000, or about 50%. That struck me as almost unreal, because a drop that size seemed so plausible. But the math was simple enough – 50 points is 50 dollars which, multiplied by 100, equals $5,000 (see, you knew I was smart, didn’t you?)

You may recall the the day I bought the put, October 6th, had the “big-ass rally” I had hoped would happen, so I actually got it at a good price. But I confess that, when I need courage the most, my testicular fortitude abandons me, and as the market opened strong on Monday, I got the willies and dumped my single put at $95.47. I was proud of myself for “only” losing $1,000.

On Tuesday, the market tumbled, and the option rose about 50%, just as my little hypothetical musing suggested it would, and I was pretty ticked-off at myself, although that was ameliorated by the gains I enjoyed on my other options positions. But here’s the point of this story: even though the stocks on which I owned puts fell by larger percentage amounts, the sheer point size of the NDX move made that put much, much, much more profitable. In other words, just being based on a high-priced index ($4,000 or so) made the moves radically juicier than anything a $30 equity could ever achieve.

On Wednesday, the market soared higher thanks to the Fed minutes, and the option sank back to where I had sold it on Monday. Thus, I felt a little less dumb. Well, i don’t need to tell you what happened on Thursday and Friday……….

That’s right: the option was about $223, more than double what I paid for it, or a profit of about $12,000 on a single put option. Un-freaking-believable. Of course, if we crash on Monday (or sometime this week – – or indeed anytime before the November expiration!) you can imagine the potential gains.

My lesson in this is twofold: first, baseless cowardice is a tremendous thief of profits, and second, these index options can absolute dwarf everything else in terms of profit power. Of course, if you look at April 15 to July 24, you’ll see that anyone buying these same index options would have lost money the entire way up, which is the bread and butter of the options sellers. All the same, this entire experience makes me think these NDX puts (and other similar creatures) could be terribly alluring.