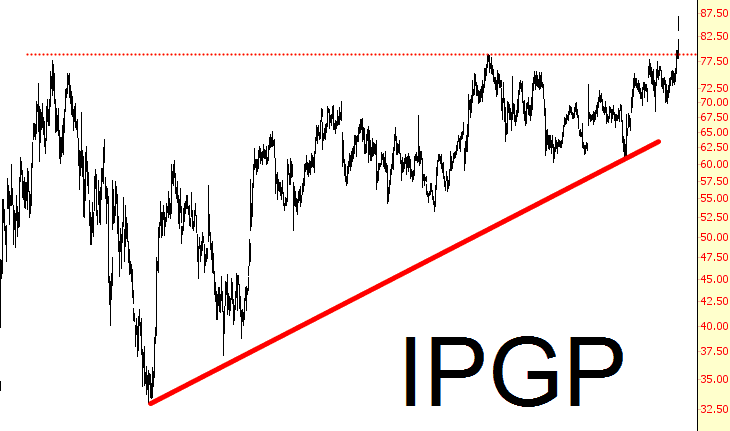

Chart Analysis

Yesterday the market closed down. In the DAILY ESH15 chart below we are examining the market distance to the first valid LONG support (2032.75) and to the SHORT resistance level (2071.75) that has odds of reversal equal to those of the first valid LONG support. As you can see the LONG support has almost been reached yesterday and may still be reached today as it is only a few points away. On the uptrend side the market has definitely room to go, so as always let’s try to imagine that the market is like a coil compressing in the LONG direction and then bouncing back and then compressing in the SHORT direction and then pulling back and we must be ready to capture profits on these swings.

The latest Higher High (circled in black on the right hand side of the chart below) is also giving us a clear indication that the market is trying to breakout higher, so the process anticipated in the last few days is currently happening and we have to see if from here the market finally pushes higher and breaks definitively out of its latest sideways move.

One of our clients yesterday sent an email to us, where he asked: “What happens to your LONG strategy if a war suddenly breaks out in Russia/Ukraine ?”. Unfortunately we can’t see into the future and it is not possible to estimate what will happen for each global geopolitical event that may affect the stock market. We use quantitative models to avoid the futile exercise of trying to predict the future through fundamental/geopolitical analysis, our models allow us to anticipate market reversals before the news are out, so we can only say that if the market tanks because of a war in Ukraine we will need to look at the TO GO LONG levels and find a good place to enter at discounted prices. The market will bounce back, as always, when that specific geopolitical situation improves and we will be already LONG before the news can tell the world that things are resolving in Ukraine.

(more…)