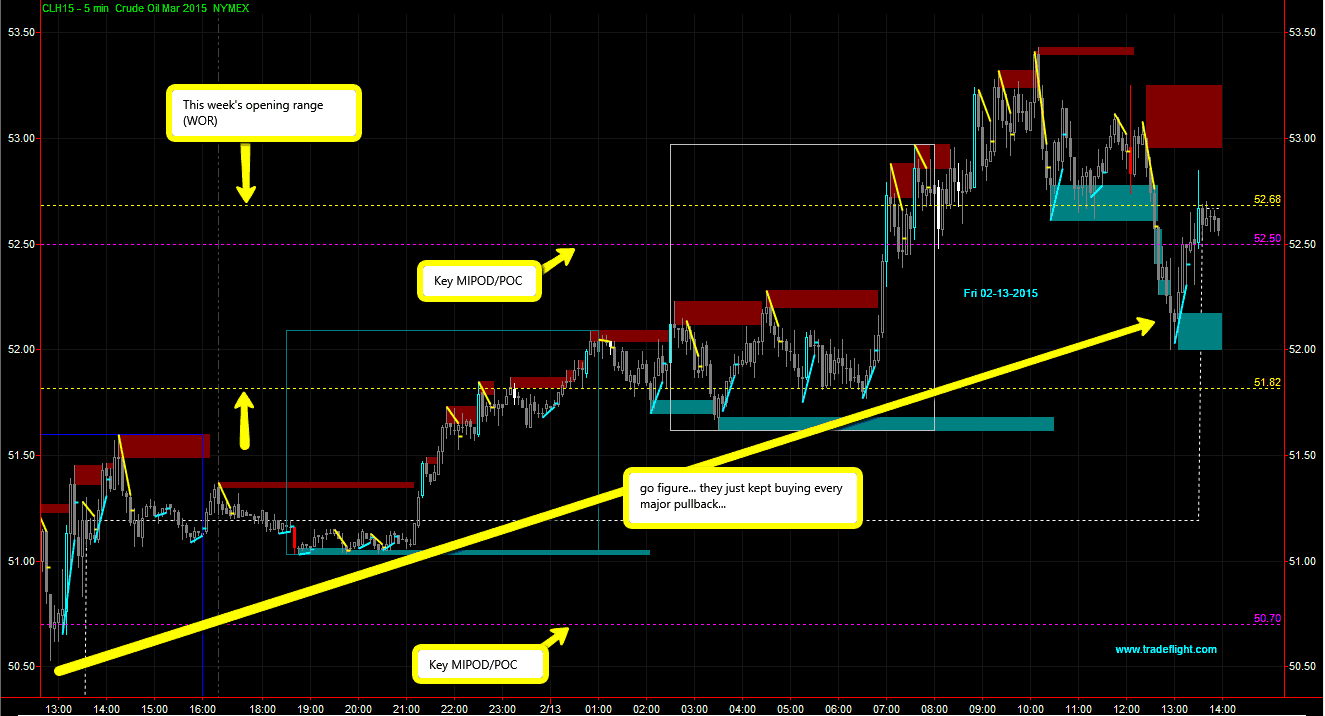

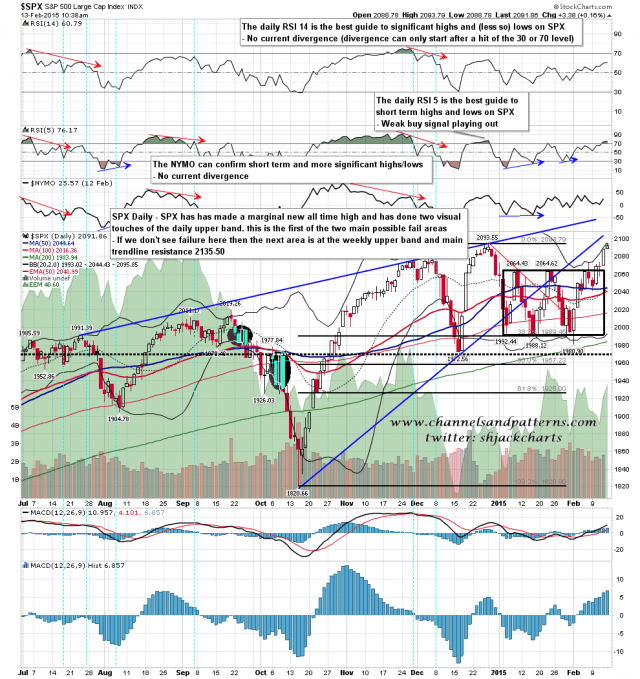

I’m in total agreement that grease monkeys need not get excited unless they rip apart 5430s. However, this week marks the first in many weeks that WTI has rotated right back to where it all started – the Weekly Opening Range (WOR) that was set Sunday night:

Experts are saying oil will head to $200 or $20 – pick a side. Meanwhile, it’s been a nice bullish week and we’ll change our minds if they start breaking down weekly opening ranges again.

There’s no point in having a bias, only order flow 😉