Hi, Slopers – – sorry I’ve been so quiet today. I had to get up super-early this morning to get one of my children to the airport. Frankly, I’d better get used to this new schedule, because starting next week, I get my own show on Tastytrade (that’s the good news) for which I have to be up at 4:30 every morning (that’s the not-so-good news). Anyway………

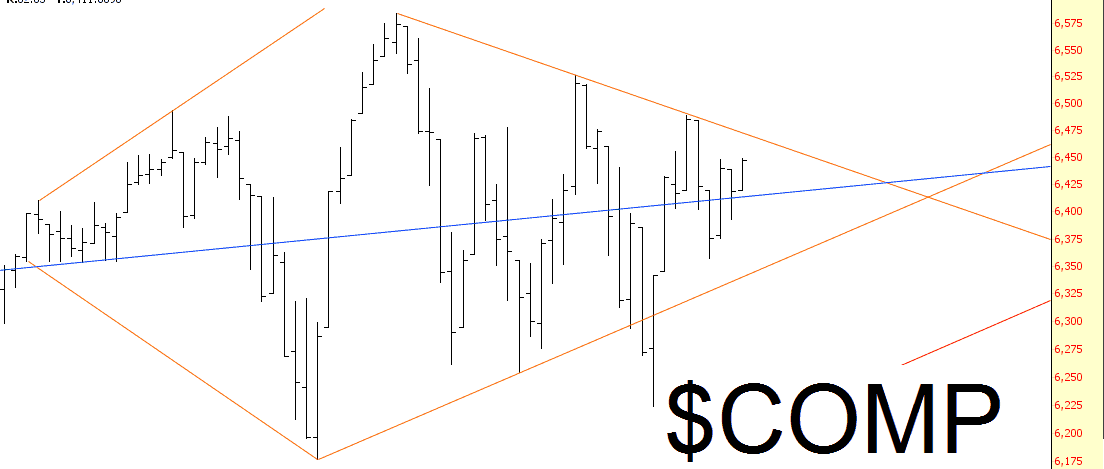

The Dow Jones Composite index fish/ichthus/Jesus pattern is still intact, although if tomorrow is anything like today, that could be over in a big hurry. For, for now, hope springs eternal in the bearish breast: