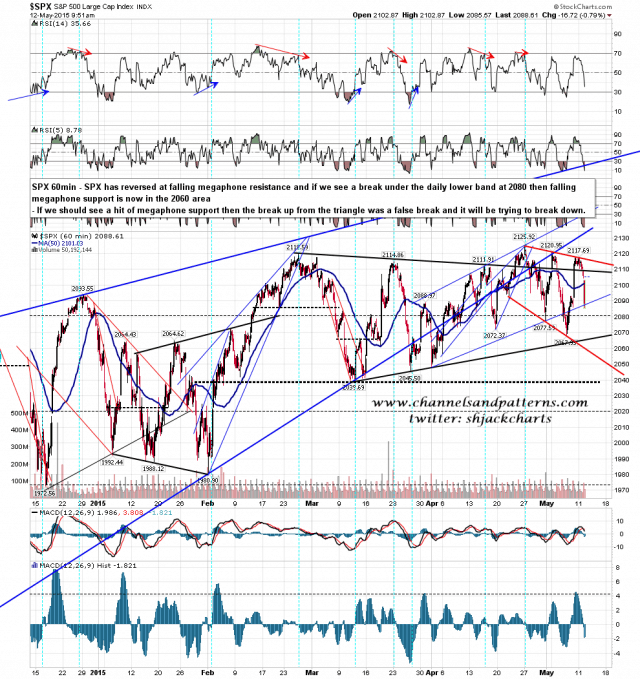

SPX tested falling megaphone resistance yesterday morning and has failed hard there, retracing 61.8% or a bit more on the six indices below. That’s about as much as the bulls can concede without most likely retracing all of the last move up. If we see a significant break below the low this morning at 2085 then I’ll be expecting more downside. SPX 60min chart:

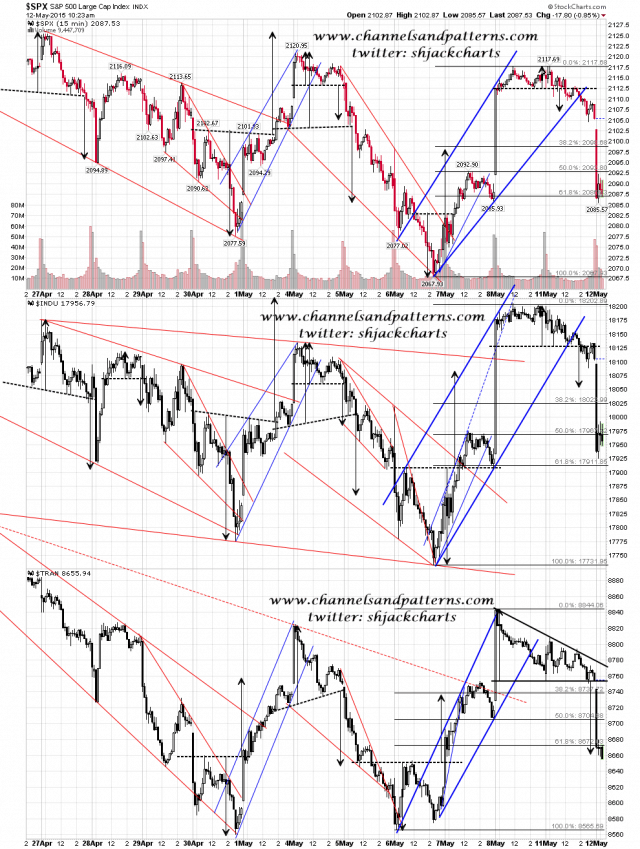

Scan 3x SPX INDU TRAN chart:

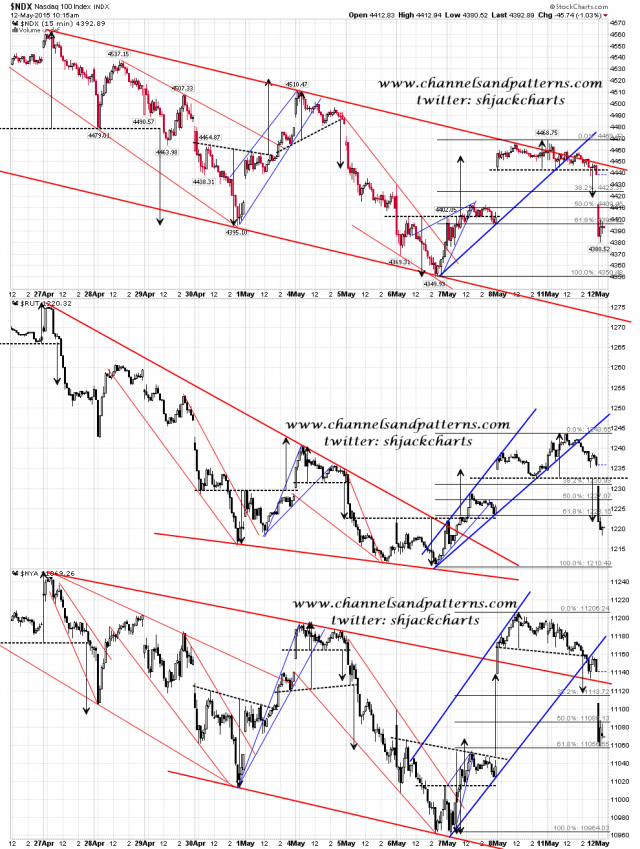

Scan 3x NDX RUT NYA chart:

There’s been a significant bounce from the opening lows, and obvious resistance at 2101/2 at the 50 hour MA and the daily middle band. On the bull case we may well still see a reversal to test the morning lows to make the second low of a double bottom. On the bear case that goes hard through the morning lows and that would open up a move back into the 2060s. If we should see a sustained break above 2102 today then that would be impressively bullish, though SPX would need to close back above the daily middle band today for it this break down to be a full fail.

One last note here is that this falling megaphone could break down. If so and the double top support at 2039 was broken, we would then have that double top, the triangle, and the falling megaphone all pointed due south to targets between 1960 and 2000. If that should happen next that break of 2039 should very much be respected.