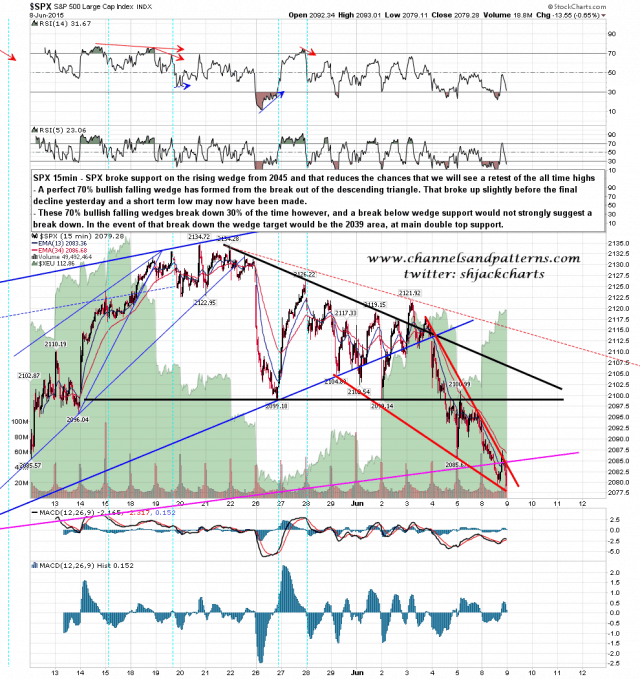

A strong day for the bears yesterday and SPX has reached another inflection point. A clear falling wedge has developed from the triangle break and that’s a 70% bullish pattern that broke up slightly before the final decline yesterday afternoon.

If that falling wedge breaks up today then I’d expect at minimum a retest of the 2095-7 area, and on a conviction break back above 2100 then perhaps a retest of the highs. if this wedge now breaks down, and we should always remember that a 70% bullish pattern will break down 30% of the time, then the target would be in the 2040 area, essentially a test of main double top support there. SPX 15min chart:

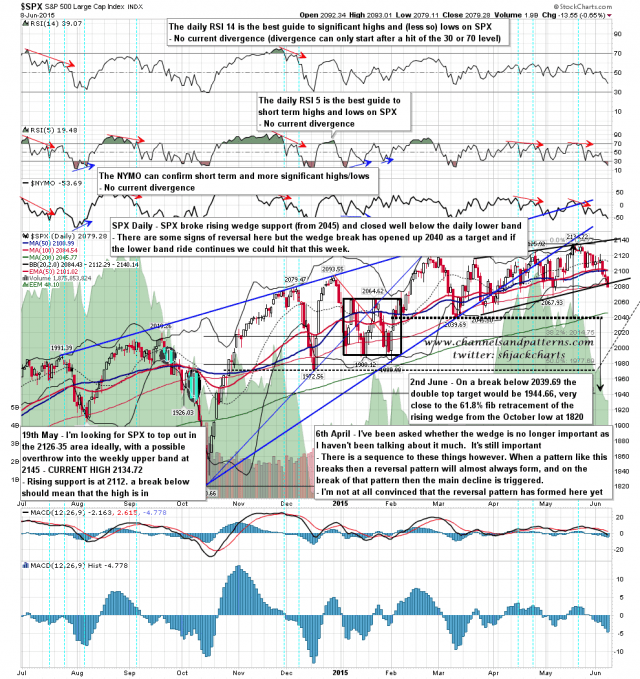

What does the daily chart tell us? Well yesterday was a model second day of a daily lower band ride, closing five handles below the lower band. If the falling wedge breaks down then the lower band ride could get us there this week. There are no bullish divergences on the daily or hourly charts yet, though there is a possible 15min buy signal brewing. SPX daily chart:

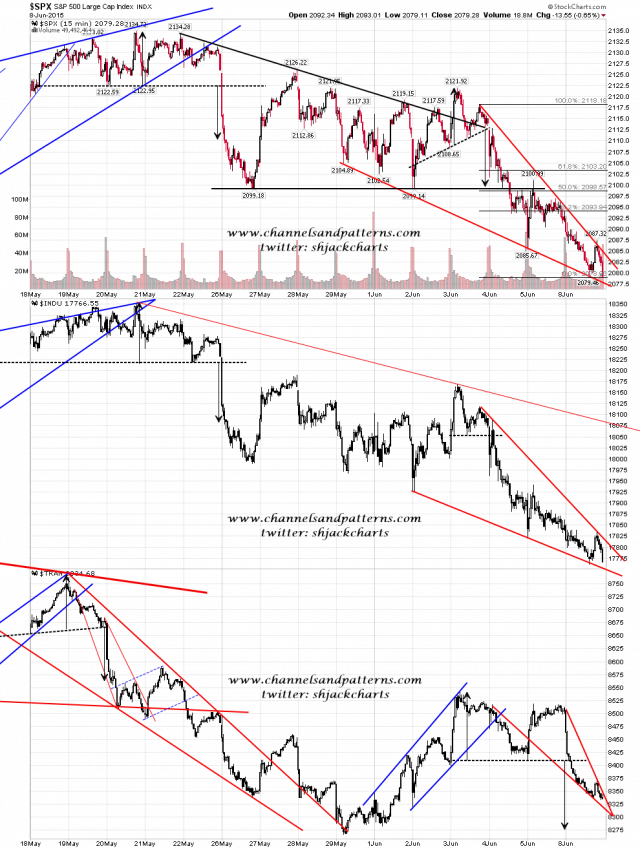

If the SPX falling wedge breaks down it won’t be alone. No doubt the falling wedges on INDU and TRAN would break down as well. Scan 3x 15min SPX INDU TRAN charts:

The 2085 level that broke yesterday is a big level, and it is opening resistance today. On a break back above it the bulls have a chance to take back control. On the downside if we see SPX break falling wedge support next then the odds would be in favor of continuation down towards main double top support at 2039. I can see decent arguments for both scenarios and at the moment this looks like a coin toss. A clear break up over 2085 or down through 2070 should be respected.