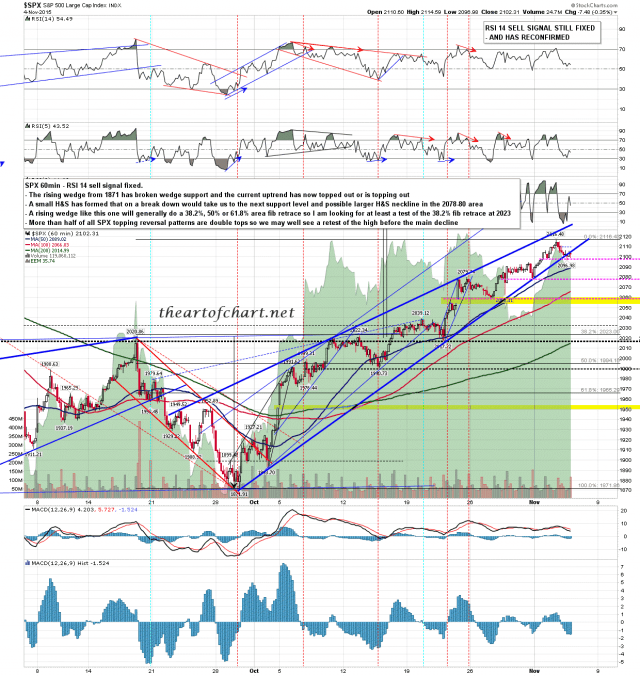

Rising wedge support from 1871 broke yesterday on SPX, and we should now have either seen the uptrend high or be in the topping process. Over half of topping reversal patterns on SPX are double tops so a retest of the highs is very much a possibility.

If bears can take early control today there is currently a small H&S targeting the 2078-80 area on a break below yesterday’s low at 2096. The 50 hour MA is important support to watch at 2089. SPX 60min chart:

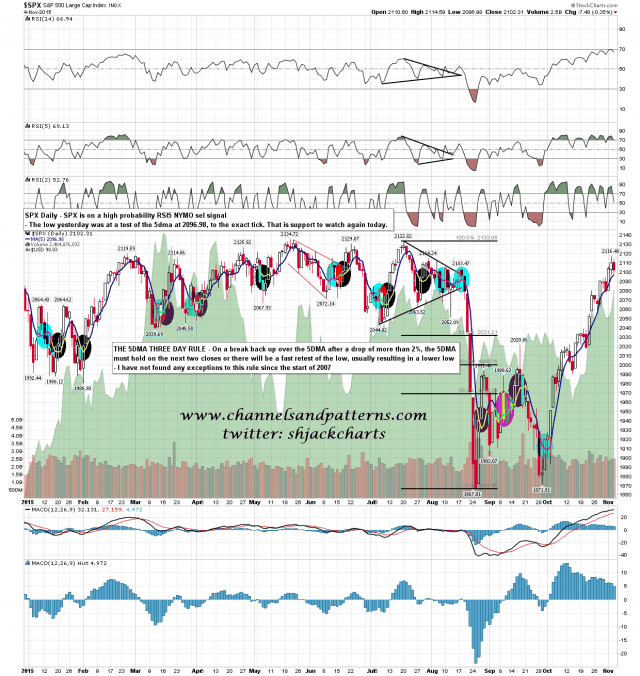

The 5 day MA was at the exact low yesterday and is support to watch today as well. SPX daily chart:

The minimum target that I am looking for on this move is a test of the 38.2% fib retracement in the 2023 area. Could we go down further? Yes, but but I’m a bit doubtful about the seasonality for a really big move. We’ll see what happens at 2020. In the meantime I’m looking for a reversal pattern to form here and have support levels for possible H&S necklines in the 2078 and 2063 areas.