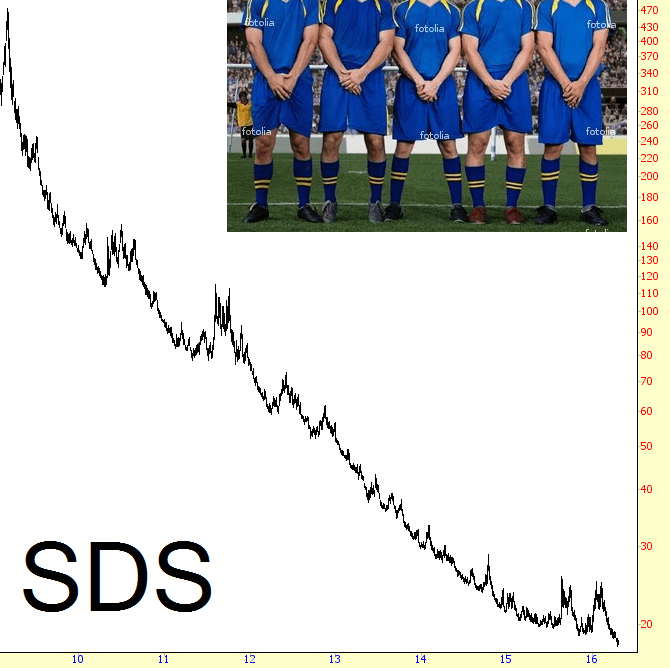

Happy Sunday to you, as we continue our general review of market charts. Just as the chart of HDGE, shown in part 1, illustrated how nasty the strength since February 11 has been to the bears, I’ve got a similar, much longer-term chart to share: SDS. This is the leveraged fund which moves at twice the percentage of the S&P 500 in inverted terms.

This chart goes all the way back to 2009, and as you can see, in all those many years, and with all that’s happened during that tremendous timespan, this has been a relatively steady, sustained slide. What’s most interesting is how “smooth” the slide has become, since the couple of bouts of “relief” the bears got (one in 2010 and one in 2011) have been completely smoothed over by a globe of central bankers whose credibility has been greatly solidified by the investing public.

In the chart above, the last couple of gasps of hope came in August of last year, and then in the first portion of this year, ending on February 11th. This week, SDS went to new lifetime lows.

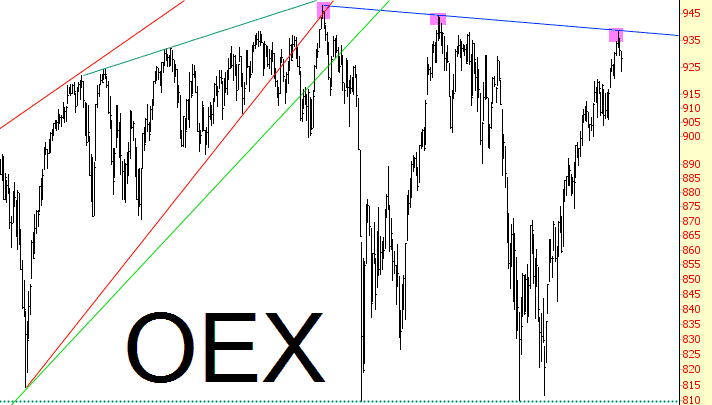

The damage to the bear case has been bad over the past ten weeks, but not all hope is lost (yet). The S&P 100, for instance, illustrates the massive topping pattern in the market remains intact, and we’ve still got a clean series of lower highs constituting the most recent portion of the pattern.

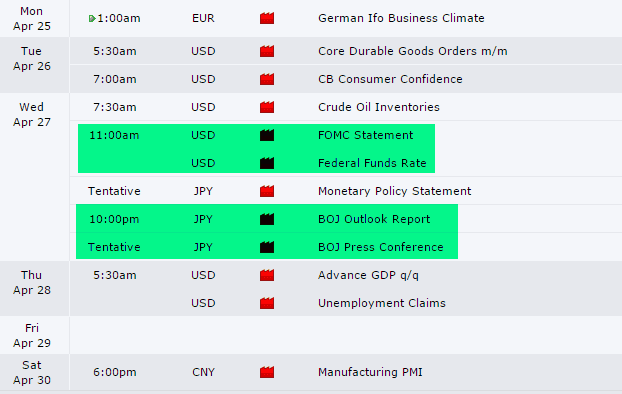

But note that I used the word “yet”, because this week there are a pair of events which could be the coup de grace for the one or two bears left: Yellen and Kuroda on the same day (Wednesday). Be afraid. Be very afraid.

I’ll wrap up with a few more charts later on.