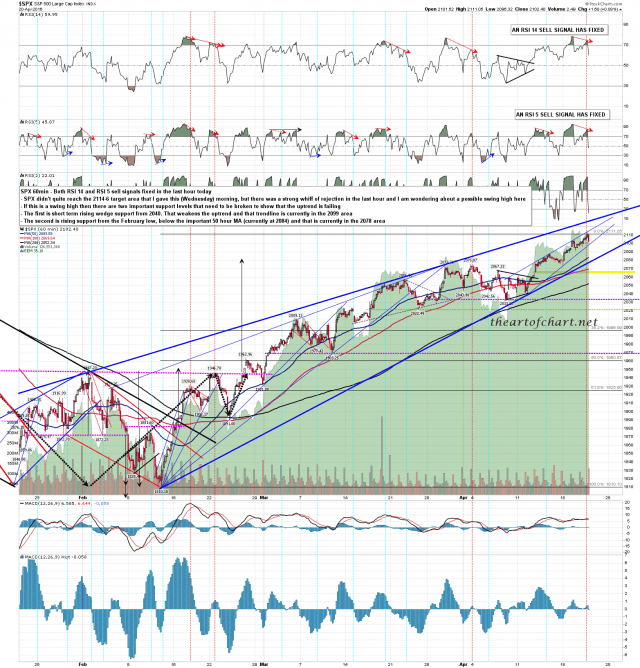

At the start of this week, on my Tastytrade show, I said that it felt like something had “snapped” in the market. There was a confluence of little events that took place that convinced me that the few remaining bears had either lost their minds or thrown in the towel. The “Disappointment After Doha” – – that is, the inexplicable rise in the market after the complete collapse of talks in Qatar last Sunday – – – was the straw that broke the camel’s back for many people.

Now, in my line of work, you’d expect me to be the recipient of a regular amount of hate mail. For one thing, my view is an unpopular one. The vast majority of people actually want assets to inflate in perpetuity. A permanent bull market would be just dandy for 99.9% of the public, and not only do I tout exactly the opposite, but I’m rather bombastic about it.