For quite a while, I was getting solicitations from a site (which I won’t bother naming, for reasons that shall soon be clear) that promised to “revolutionize” investing by showing actual results of portfolio picks to the investing public. This kind of web site has been done a dozen different ways over the years, so it was hardly unique, and my skin crawls any time any tech company promises to “revolutionize” anything, even if they find a comely lass (that can’t stop smiling) with an off-the-shoulder dress to promote its virtues.

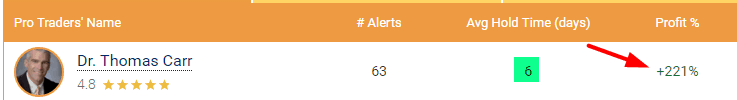

I had pretty much forgotten about the site, but for no particular reason it occurred to me to check in on them and see how they were doing. The site was up and running, and on the home page was a list of their superstar stock pickers and their returns. I was sort of blown away to see the result at the very top: