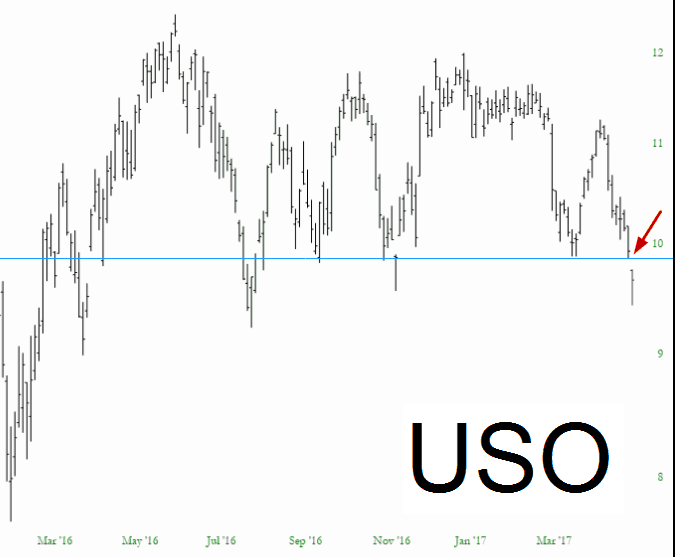

The highlight of last week for me was energy’s breakdown (well, the real highlight was the launch of SlopeCharts, but the trading highlight was energy). Looking at the USO chart, you can see the clean break. I consider it plausible that crude oil will see the upper 30s before a meaningful reversal.

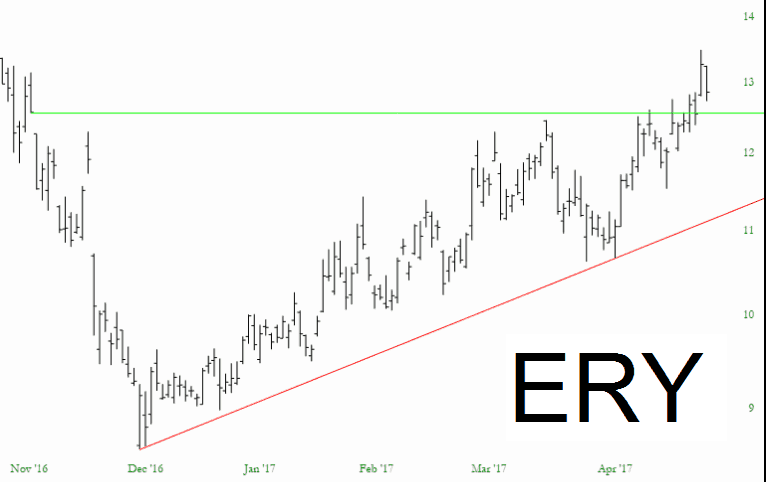

I trimmed my ERY long position about 40% on Thursday, but I intend to get back in at hopefully better prices. The cup and handle pattern is still quite clean.

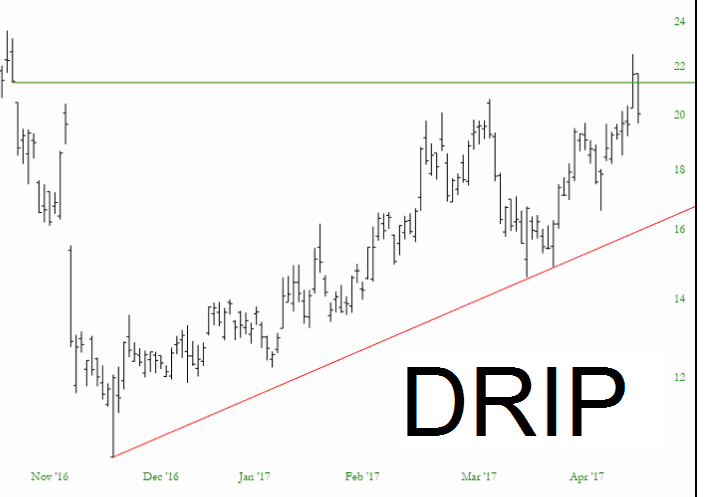

I did a day trade on DRIP on Thursday for a small profit, and I’m glad I got out, since it slipped over 10% the next day. These patterns are both quite similar (for obvious reasons, since they are both triple-bearish energy funds), but I think I’m going to stick with ERY.