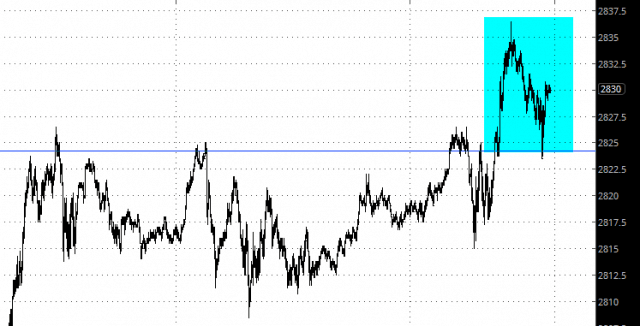

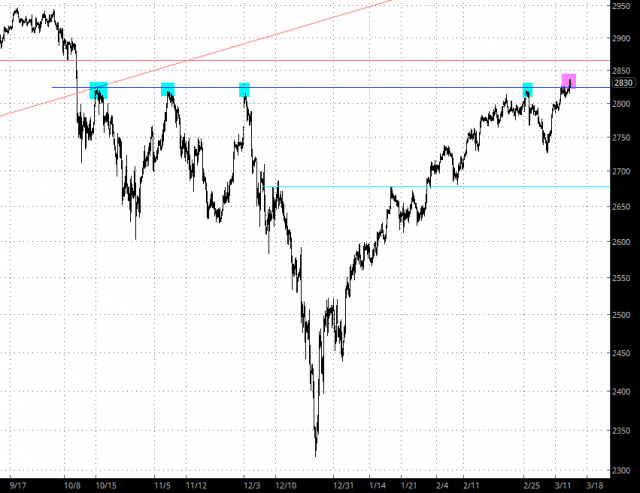

The horizontal line which, for months on end, the bulls weren’t able to push past was finally defeated on Friday. It seems that all week long, the ES kept trying to break through, and although it got maybe a point or so above the line, it was always repelled. That is, until Friday, at which time it swifted tacked on 10 points, dropped to test the line successfully, and strengthened once more.

So is this “all clear” for the bulls? Well, it’s certainly a positive. In any situation, the longer support or resistance maintains its role, the more powerful it becomes when that role is reversed. It took nearly half a year for the ES to finally do what it had been trying to do, and now that 2825 level (approximately) is the friend of the bulls, not the enemy.

I’ve read a lot of chatter about how bullish quad-witching week is, and now that we’re past it, we’re going to tumble anew. Maybe. But I wouldn’t count on it. Listen, there’s no one on the planet that would love to see stocks slump more than I would, but I’m not going to pin my hopes on some obscure statistic.

The plain, simple truth is that ever since Jerome Powell completely caved (his laughable denials notwithstanding……….), liquidity has been pouring into global equities by the trillions. The “about face” that happened on Christmas, thanks to the Mnuchin/Trump/Powell triumvirate, is truly historic.

Suffice it to say that 2825 is more important than ever, and a failure beneath that level is just about the only thing that could save the bears at this point. Otherwise, it’s a straight, easy shot to 2865.