Last Friday I was saying that my preferred scenario on SPX would deliver a marginal new rally high to make the second high of a double top to then take SPX back into the 2600-50 area. We have seen that marginal higher high, the middle of this cycle high window is today, and the stats for next week lean significantly bearish. If everything keeps going to plan then SPX is about to reverse down here and this high may be the 2019 high, though I’m still wondering about a possible ATH retest after the next big low window in June.

There was a very nice setup for reversal across the board on indices this morning, but in my premarket video I was doubtful about those delivering anything today just because the stats for today are so historically bullish, and so it has turned out. Updates on five equity indices and seventeen other instruments on my premarket video from this morning.

As an aside, I was told a few weeks ago after posting one of videos these here that I tend to go pretty fast in these premarket recordings, and that’s true, and that I should consider taking it a bit slower, which I won’t, as it is fast for a good reason. I’m reviewing the salient trading setups on twenty two tickers in less than ten minutes every morning, and I don’t like the videos to run over ten minutes because people are busy in the mornings. All the futures charts shown are also uploaded to the website for subscribers to review, and these videos are recorded for those subscribers rather than intended for general consumption. It’s a compromise and, if I’m going too fast for you, please just use the pause button.

Full Premarket Video from theartofchart.net – Updates on ES, NQ, RTY, DAX, ESTX50, SPX, NDX, RUT, CL, NG, GC, SI, HG, ZB, KC, SB, CC, ZW, ZC, ZS, DX, EURUSD, USDJPY, USDCAD, AUDUSD:

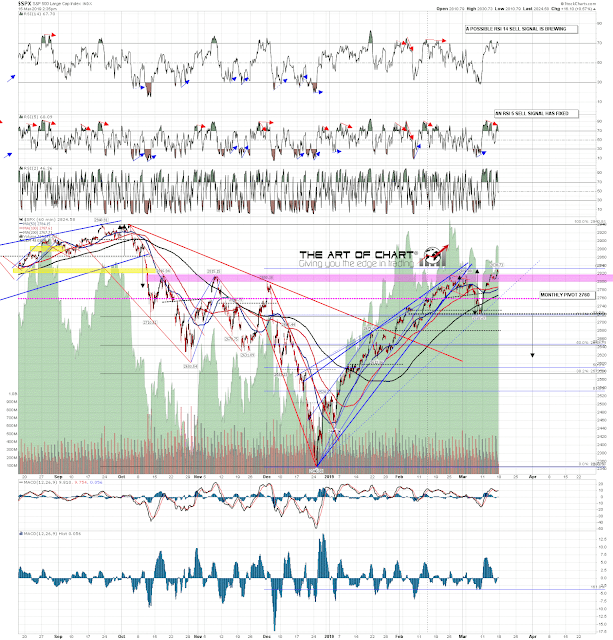

There’s now a high quality double top setup on SPX which on a sustained break back below 2722 would look for a target in the 2615 area. An encouraging possible hourly RSI 14 sell signal is brewing. I like a sustained reversal from this area.

SPX 60min chart:

On NDX the original rising wedge has expanded into a larger version of the same rising wedge and that has now delivered a slight bearish overthrow A classic bearish setup and another promising hourly RSI 14 sell signal is brewing. On NDX I also like a reversal from this area.

NDX 60min chart:

RUT has delivered a decent lower high. DAX has a solid double top setup and the ESTX50 setup is very similar to NDX, with the exception so far of the bearish overthrow. We might see marginal higher highs on all of these, but the topping setups look cooked and ready to deliver. Next week should be interesting.

Everyone have a great weekend. 🙂