It has been a while since we’re introduced any new technical studies to SlopeCharts, but we’re going to be beefing up this portion of the product. The newest entry, available to you right now, is the Average Directional Index (ADX).

The most important thing to understand about ADX that makes it different than most indicators is that, in spite of the word “directional” in its name, it actually should not be heeded for guidance about direction. The indicator is all about trend strength. In other words, the ADX could be moving higher and higher while prices are moving lower and lower, and all the ADX is telling you is that the trend is strong and getting stronger. The fact ADX is going “up’ doesn’t mean prices are doing the same.

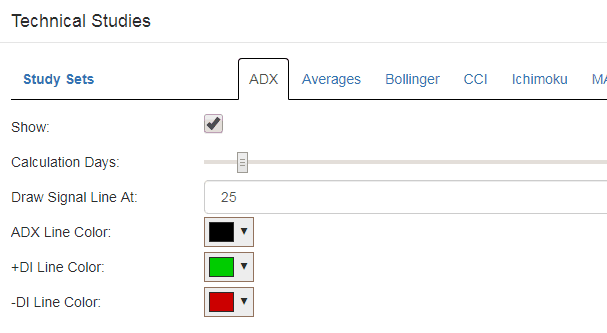

The ADX, like all technical studies, is accessed via the studies dialog box. In the ADX tab are these controls:

- The “Show” checkbox controls whether the ADX pane is displayed;

- Calculation Days is a slider bar that can be moved left (fewer days) or right (more days). It has a default of 14, which is considered the standard for the study.

- Draw Signal Line is a dropdown which lets you control if a horizontal line is displayed. ADX users typically like a line at either 20 or 25 to make it easy to see whether or not the ADX line is above such a level (if it is, the trend is considered strong).

- Finally, you can change the colors for the Average Directional Index (ADX), Minus Directional Indicator (-DI) or the Plus Directional Indicator (+DI).

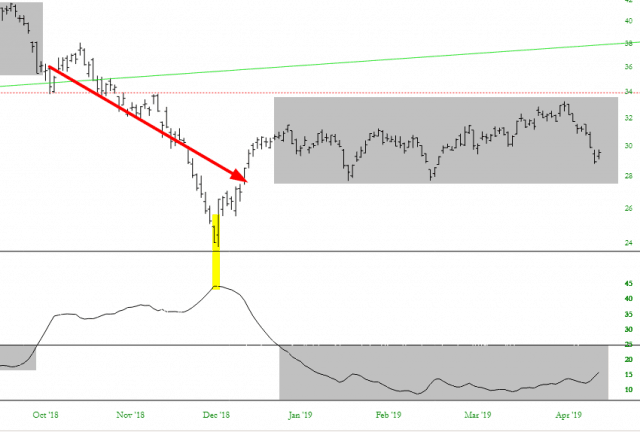

Below is an example of the ADX, in this instance being used with symbol IWM. The grey area denote portions when the ADX was below 25 (marked on both the ADX pane and the price pane for clarity). These are areas where prices tend to be “range-bound’ and not trending strongly.

The places in which there is no tint indicates an ADX above 25, suggesting a strong trend. Again, take note that the major “trend” on the left side of the chart was downward, and the ADX’s upward movement simply was affirming the strength, not the direction, of the trend. The yellow tints merely indicate points at which the ADX pivoted lower, suggesting a diminishment of trend strength, even though it remained above the 25 level.

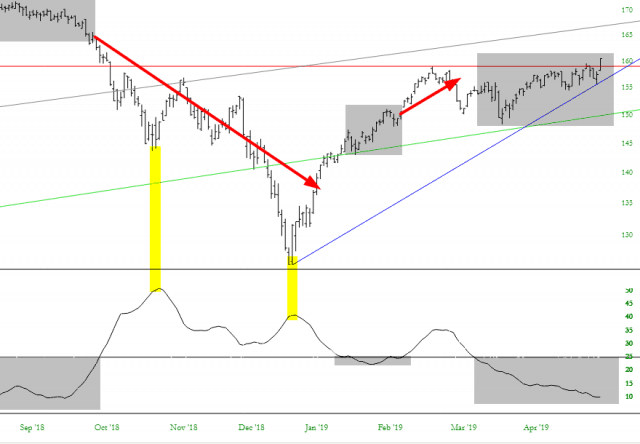

Another example can be seen with the oil and gas exploration fund symbol XOP. Much of the chart meanders higher and lower within a range, and the ADX (greyed out) is persistently beneath the 25 level. The left portion of the chart, however, did have a strong trend (which was driving prices lower).