Ever since the regular session close on Thursday, I’ve been glancing at the ES and NQ from time to time. It’s been an absolute madhouse. Up double digits. Down double digits. Whipping all around like crazy. The bizarre thing is that all the relevant parties are asleep, so I have no idea what the algos think they are trading.

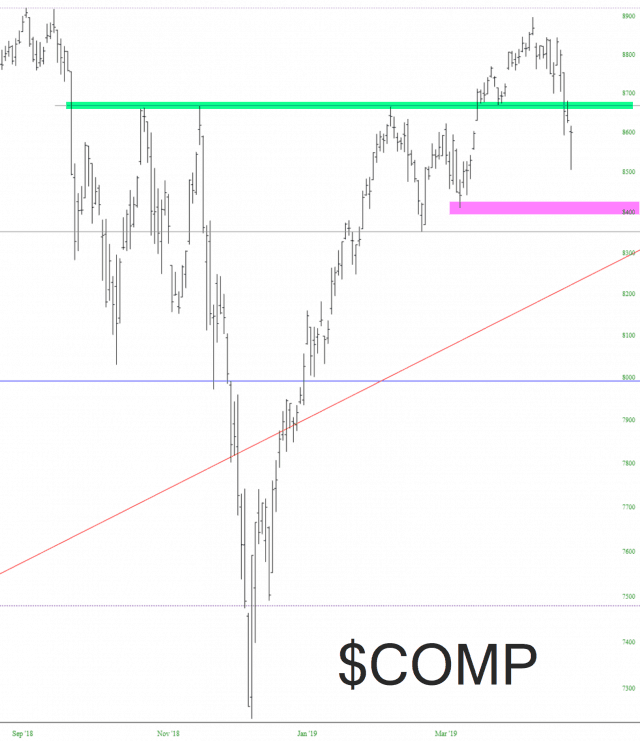

Anyway, I marked up a few big cash indexes with two levels each: one, in green, shows the level which, if crossed, puts the bulls back in the driver’s seat; and two, the magenta level which, if broken, affirms bearish control of the market. This week has already been insane, and Friday could be the craziest day of them all.