You know what happened……….

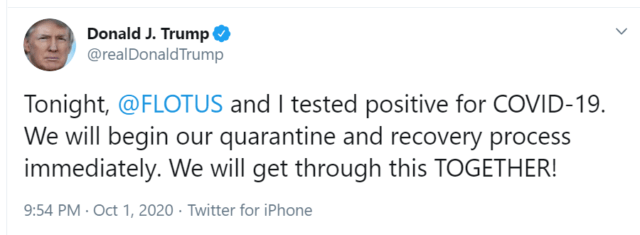

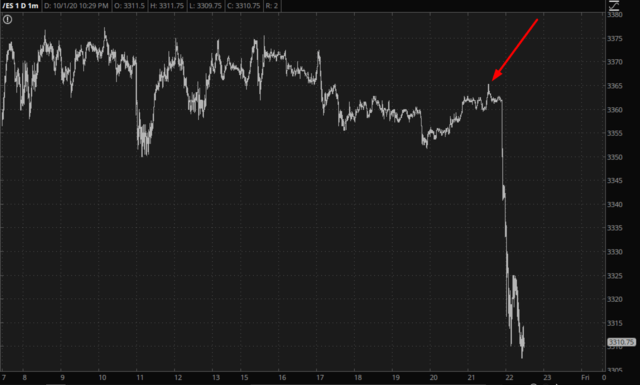

The markets are not numb to this news. It’s subtle, but I’ll try to point out roughly where the information was released.

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

In these times of trouble, with so much antipathy toward government, this is a heartwarming clip. It isn’t new – – it’s from back in 2017 – – but it simply shows the great Dave Chapelle at the town meeting where he lives, which is a small community in the middle of Ohio.

I’m planning to drop some COVID-19 info and updates into some of my posts, hopefully in a way that won’t get people thinking that I’m taking a position in the US election, as it is of vital interest for the economy going forward, and there was a time when that mattered for stock markets too, though that seems less certain at the moment.

I was giving the best guess mortality stats for the virus on Tuesday, and just wanted to break those down a bit further. The bottom line really is that, subject to some variations depending on race, sex and existing co-morbid health conditions, and in the event that anyone is actually infected, as many may well never be infected, then the death rate for those in the 12 to 40 age range is about 0.01%, or one in ten thousand, the death rate for people in the 41 to 60 range rises to about 0.1%, or one in a thousand, and the mortality rate rises sharply for those 60 or over to about 2%, or one in a fifty. That last stat is heavily weighted towards the oldest and least healthy in the population, to the extent that the average age of death from COVID-19 among white people in the Indiana study I was referring to was 78.9, with over half of all COV-19 deaths in Indiana among nursing home residents.

(more…)With the first Trump-Biden debate of 2020 in the books, we’ve headed into the final stretch of the 2020 election. Let’s note the election risk and then look at how to protect against it.

A couple of weeks ago, a Finnish business journalist asked me which candidate would be worse for the market. I told her that the risk in the near term wasn’t either candidate winning, but neither candidate winning: that the best thing for near term returns was a decisive election night victory. In a Wednesday article (“As Election Looms, Investors See Uncertainty. They Don’t Like It.”), investment professionals interviewed by the New York Times made similar points. For example:

(more…)