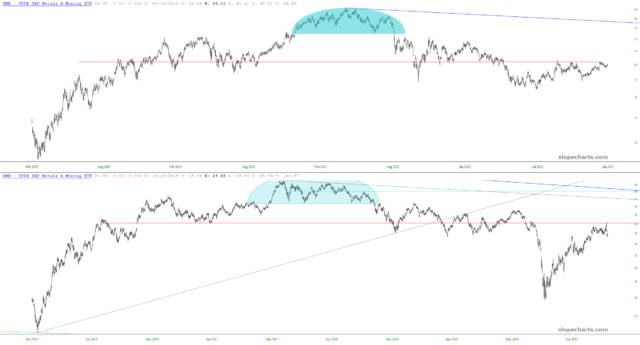

On Tuesday I talked about how you can improve virtually any system by filtering on ATR basis.

This is so obvious in retrospect, I can’t believe I didn’t notice this earlier in my trading career. High volatility and low volatility periods have completely different psychology, the same way trending and rangebound markets are driven by opposite psychology.

Basically, during decreasing volatility trending moves, counter trend setups are a negative edge.

But counter trend setups become viable again once ATR (as a proxy for volatility) reaches a historic low and then rises.

This is because volatility, once it starts falling, has a statistical tendency to continue falling until it reaches an extreme.

(more…)