The market has gone catatonic. Volume is anemic. The put/call ratio is the lowest it has been in twenty years. Daily ranges are as big as Hervé Villechaize. In spite of all that, let’s take a look and some updated index charts.

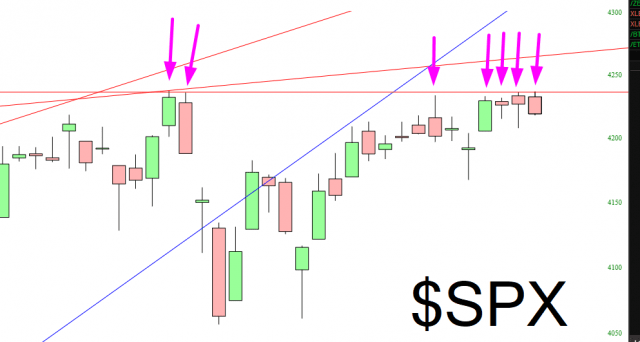

Starting off with the S&P 500, you can see that it has tried, and failed, on seven different occasions to push past the horizontal line. It’s getting kind of ridiculous at this point. Indeed, four days in a row just recently. I can’t remember ever seeing anything like this in my life. (Of course, in this totally fake market, nothing surprises me anymore).