Truly mind-boggling:

(more…)Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

Black Gold Beats Silver

Merrill Lynch Mob

I seriously doubt anyone here would consider signing up with Merrill Lynch Edge as their trading platform, but just in case you do……………...don’t! I already have accounts with several brokerages, but I intended to set up one with Merrill since it is linked to B of A. I won’t bore you with the details, but after two months – – two MONTHS – – of trying to set up a simple options account, I finally threw in the towel and gave them wiring instructions today to get my money back.

For me, the last straw was after the 4th time (yes, 4th time) of faxing (yes, faxing) my options agreement in, they rejected in once again because this time they claimed it didn’t have a “wet signature”. I assured them it was wet – – dripping wet – – but they claimed it was electronic. Even though I printed a form, filled it out by hand, and faxed it to them. So…………in my opinion, Merrill Lynch Edge sucks out loud, and I urge you to stay far, far away.

A Lot Of H&S Patterns Forming

I was looking at something unusual in my premarket video at theartofchart.net this morning and that was a large number of H&S patterns both bearish and bullish. I don’t generally post my work here outside the equity indices but I’ll make an exception today as these are worth a look, and all really coming out of the reaction last week to the Fed indicating that tapering of COVID measures is starting soon in the US.

The first of course is the possible H&S forming on SPX that I was writing about yesterday. This is in the ideal right shoulder area and SPX is now in the inflection point seeing if this will now break down. If it doesn’t I’ll be looking for the high retest, but the historical stats and setup here are favoring a break down.

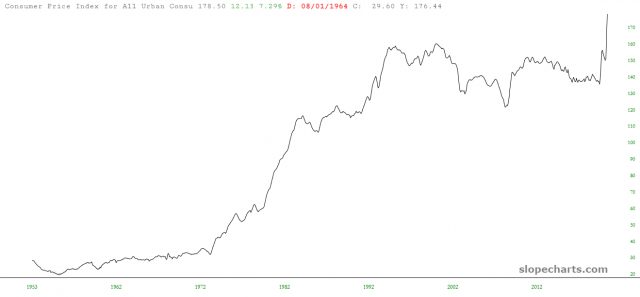

(more…)Used Rocket Ship

We’ve all heard about how used car prices have been going. I thought I’d see if SlopeCharts had anything to say about this, and sure enough, it did. Here is, straight from the federal government, the index for all used car prices since way back in the 1950s. They actually had their own bear market, ending around the depths of the financial crisis, and for the past year, prices have done a total bottle rocket.