I don’t think a single person here needs any more evidence that the Fed is totally, completely, and utterly in control of equity markets. All the same, I wanted to show you a couple of dual SlopeCharts to help drive this point home.

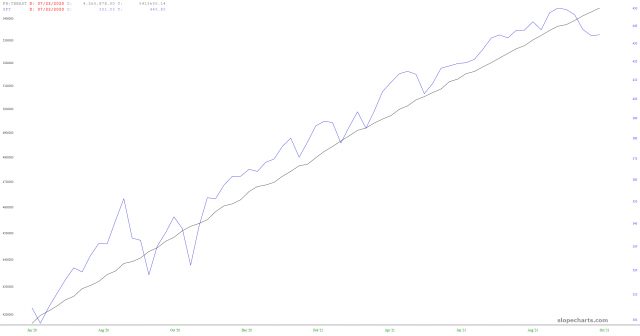

This first one shows the total Fed assets (a figure which used to linger in the lower hundreds of billions and was used to tweak things now and then, but now has grown into a laughable nearly $9 trillion slush fund). You can see how the financial crisis in 2008 was met with an enormous heroin-shot of asset purchases, which at the time took months to take effect.

The reason is took so long is because the market was still behaving as a market. It had not developed its finely-tuned expectation that the Fed would bail out the poor little bulls any time there was the slightest downdraft (as we’re witnessing this very day). Can you imagine the Fed gobbling up trillions of dollars in securities over the next few weeks and the market not responding? Of course not. That’s because the market has learned that the Fed had completely abandoned any notion of normal capitalism. It has become a completely contrived and captured market, jerked this way and that by Jerome’s machinations.

As evidence of this tight relationship, just look at how different recent history has been. with the S&P 500 obediently and slavishly following Fed Assets without barely any sunlight between the two of them, not unlike the intertwined snakes of medical symbolism pictured above.

This is no different for the “Securities Held Outright” by the Fed price series of the dear souls at the Eccles Building. This actually seemed to bob and flow more consistently, even back in 2006-2009.

Again, looking at recent history, stocks and the Fed are in lockstep. (The nearly perfect straight line is, of course, the Fed’s bond purchases, which follows clockwork regularity).

The $30 trillion question is, of course, why – – why on Earth – – would the Fed ever, ever, EVER stop gobbling up securities since it works so well?

Search me. God knows, a dozen years of this fraud have worked out marvelously, and while Powell should be hanging upside in prison, he is instead lauded as a hero, a genius, and a patriot. It’s appalling.

I suppose, putting our science fiction caps on, that if something – – like, say, inflation, but it could be anything – – starts racing out of control, and the Fed simply can not, and will not, buy any more securities, then it’s Game Over, Man. But, sincerely, it’s going to take something calamitous to get them to stop. Because, again, twelve years of screamingly-pleasurable heroin addiction is tough to stop.