Well, if there were any equity bears left on the planet at all this morning, they are surely deceased by now. At long last, the Fed announced tapering, and – – perversely, considering how bond purchases are 100% responsible for every tick the market moves – – the market exploded to lifetime highs across the board.

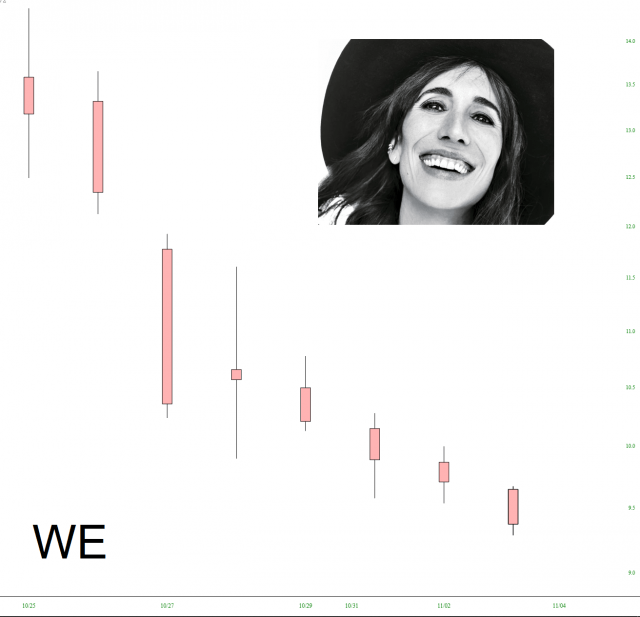

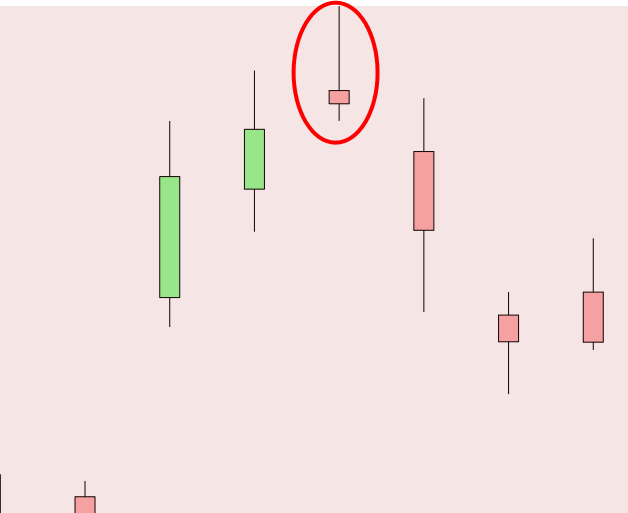

Not that there are any bears left who need to grasp a reed of hope, but I present to you the fact that the “push to the broken wedge analog” is still intact. Of course, it can remain intact in perpetuity while the market makes new lifetime highs every day. That’s the nature of ascending trendlines.