Before I get started I want to encourage all of you interested in trading options to sign-up for my free weekly newsletter. No, I’m not going to send you more than the one email a week and no, I’m not running a service. I’m a trader. This is completely free from all marketing. You will find educational topics, research, trade ideas, weekly indicators and more each week. I’ve been on Slope for a long, long time and would love your all of your support. Thanks.

Click the following to sign-up for:

Back on October 6, 2021 I posted an article titled, Embrace Volatility: Three Inflation-Based Options Strategies that Bet on the Financial Sector.

Within the article I discussed three different options strategies on the financial sector, as represented by the SPDR Financial Sector ETF (XLF). The beauty of options is that each approach either was, or remains, profitable.

Since then I’ve posted a few trade ideas on gold and another inflation hedge, each of which have made profits. Here is the most recent post, where I applied a bull put spread:

As I’ve stated before, I’m not going to get into the lengthy details on my inflation stance. As a quant-based options trader, I fully understand my opinion on the matter means little; it’s more about the strategy I employ that truly allows me to make a return. So today, as always, I’m going to focus on strategy and statistics.

As we all know, inflation is here. How long it lasts is anyone’s guess. Hell, the Fed for months said we shouldn’t worry; now it seems the rhetoric has changed. None of it matters, because the facts state what we need to know and those show that inflation is happening at an ever-growing pace.

The real question is, how can we take advantage?

Just a few weeks ago I posted an inflation trade idea based on gold. The return on the trade just a few weeks later was 8.2%. Certainly not a “make you rich” trade, but hey, I don’t play in that arena, as it’s truly for suckers that don’t truly understand statistics. I want to be the casino, the insurance company or the seller of lottery tickets. Why? Simply stated, the law of large numbers. Moreover, I was able to take some decent short-term profits off the table when most market participants were struggling.

Remember, one of the key reasons why everyone should learn how to use options is to know how to hedge. And options truly offer us the best opportunity to hedge.

Today I’m going to take the same approach as my last trade idea, keeping my probabilities of success at around 80%.

For the past year gold, as seen through SPDR Gold Shares ETF (GLD), has been trading in a range between roughly 160 and 180.

Where it heads next is anyone’s guess. However, we do have a few strategies that we can use to take advantage of the popular commodity, especially when we take a closer look at the expected move for the March expiration cycle.

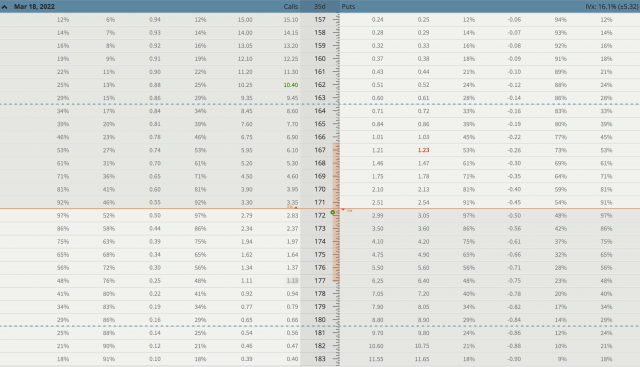

As you can see, the expected move for GLD for the March expiration cycle is from roughly 166 to 177, so my goal would be to place a trade outside of the expected move.

An iron condor would certainly be a viable strategy choice. I could sell the March 180/185 and 160/155 iron condor for roughly $0.55, or a 12.4% return—a trade I will probably discuss in further detail next week.

But, like last time, I want to take a look at an alternative trade using a bull put spread.

A bull put spread, otherwise known as a short put vertical spread, is one of my favorite risk-defined options strategies.

As the name of the strategy implies, a bull put spread is, well, a bullish-leaning strategy.

But it is important to note that the strategy doesn’t require the security to move higher to make money. With bull put spreads you not only have the ability to make a return when a security moves higher, you can also make money if the stock stays flat or even if the stock pushes slightly lower.

The first step in placing a bull put spread, or any trade, is making sure the security we are interested in is highly liquid. We always want to use the most efficient products possible. It just doesn’t make sense to have to make 5% to 15%, possibly more, to get back to breakeven.

SPDR Gold Trust ETF (GLD)

GLD is a highly liquid product, so we can move forward with a potential bull put trade.

As seen in the chart above, GLD is trading for 171.81.

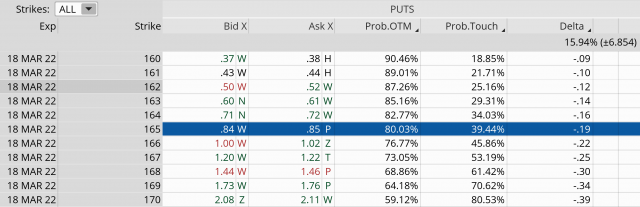

The March 18, 2022 expiration cycle with 35 days left until expiration fits the bill. As a result, let’s take a look at the put strike with approximately an 80% probability OTM (out-of-the-money), otherwise known as the probability of success on the trade.

It looks like the 165 put strike, with an 80.03% probability of success, is where I want to start. The short put strike defines my probability of success on the trade. It also helps to define my overall premium, or return on the trade.

Once I’ve chosen my short put strike, in this case the 165 put, I then proceed to look at a 3- strike wide, 4-strike wide and 5-strike wide bull put spread to buy.

The spread width of our bull put helps to define our risk on the trade. The smaller the width of the spread the less capital required. When defining your position size, knowing the overall defined risk per trade is essential. Basically, my spread width and my premium increase as my chosen spread width increases.

For example, let’s take a look at the 5-strike, 165/160 bull put spread.

The Trade: GLD 165/160 Bull Put Spread

Simultaneously:

Sell to open GLD February 18, 2022 165 strike

Buy to open GLD February 18, 2022 160 strike for a total net credit of roughly $0.47, or $47 per bull put spread

- Probability of Success: 80.03%

- Total net credit: $0.47, or $47 per bull put spread

- Total risk per spread: $4.53, or $453 per bull put spread

- Max Potential Return: 10.4%

As long as GLD stays above our 165 strike at expiration in 35 days, I have the potential to make 10.4% on the trade.

In most cases, I will make slightly less, as the prudent move (and all research backs this up) is to buy back the bull put spread prior to expiration. Typically, I look to buy back the spread when I can lock in 50% to 75% of the original credit. Since we sold the spread for $0.47, I want to buy it back when the price of my spread hits roughly $0.20 to $0.10.

Of course, there are a variety of factors to consider with each trade. And we allow the probabilities and time to expiration to lead the way for our decisions. But, taking off risk by locking in profits is never a bad decision and by doing so, we have the ability to take advantage of other opportunities the market has to offer.

Risk Management

Since we know how much we stand to make and lose prior to order entry we have the ability to precisely define our position size on every trade we place. Position size is the most important factor when managing risk, so by keeping each trade at a reasonable level (I use 1% to 5% per trade) allows not only the Law of Large Numbers to work in your favor…it also allows you to sleep well at night.

Moreover, I like to take off the trade if my original credit, in this case $0.47, reaches 1x to 2x my credit. So, I would look to take off the trade if it hit $0.94 to $1.41.

As always, if you have any questions, please do not hesitate to email me or post a question in the comments section below. And don’t forget to sign up for my Free Weekly Newsletter for weekly education, research and trade ideas.