Since I don’t trade the futures markets, I have been monkeying around with the site to while away my time as I wait for the opening bell tomorrow. I created another really powerful example of a Layered Chart that I wanted to share with everyone.

What I did was chart $BIGSUM which is the summation of advance/declines and plotted it against the S&P 500 cash index. I used the “Synch” function to line these up, and a very cool chart ensued.

Not surprisingly, the charts more or less follow one another. After all, if more stocks are gaining than losing, the market overall will be rising, and vice versa. On the left side of the chart, you could see they were pretty much in lockstep. After the Financial Crisis, the index (blue line) tended to get more and more space from the advance/decline line.

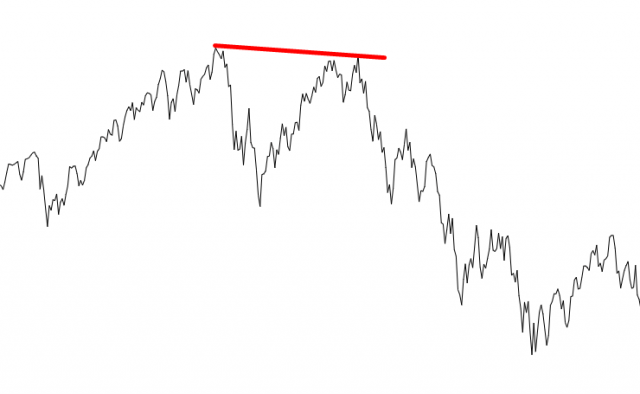

There are a couple of things that really stand out about this chart, however. The first is that, prior to stocks collapsing in the financial crisis, there was a pretty nice “tell” with respect to a divergence in the $BIGSUM. The stock market reached a peak even though the summation had a “lower high”.

The vastly more interesting, and more recent, insight happened over the past few months. The BIGSUM actually reached a peak way back in June of last year. Look how long it took for the market to get the memo. Breadth kept getting weaker and weaker, with many formerly hot stocks entering their own private bear markets (Palantir, Virgin Galactic, and hundreds of others).

The stock market itself peaked on January 4, 2022 (a date that I suspect will be one cited over and over again for decades to come), and finally it started rolling over.

In other words, it took a full HALF YEAR for the grinding erosion of the market overall to finally be reflected in the mega-cap stocks and thus start to hit the market in general.

I daresay the bear market, which began on precisely January 4th, will likewise grind on slowly and inexorably for vastly longer than anyone dares imagine.