Good morning, Slopers, and welcome to CPI day. I’m typing this post thirty minutes before The Big Event, and, unsurprisingly, trading has been flat as a board all night, since there have been no reasons (not even SBF!) to push the markets either up or down.

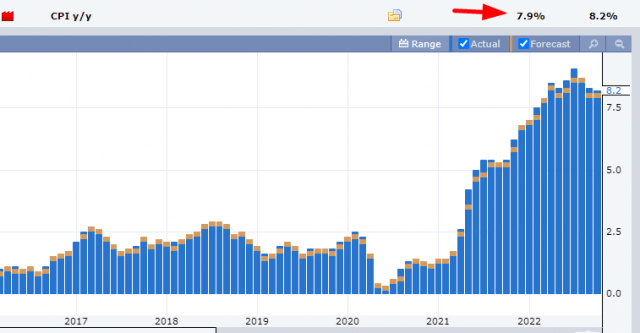

The expectation is for 7.9% annual inflation. Any chatter of “pre-election manipulation” will be gone now, although I’ve never believed such cloak-and-dagger stuff. I think the numbers are overall puny compared to what I’m actually witnessing (like the $55 dinner my wife and I had last night at a restaurant, which was basically two bowls of soup) but so be it.

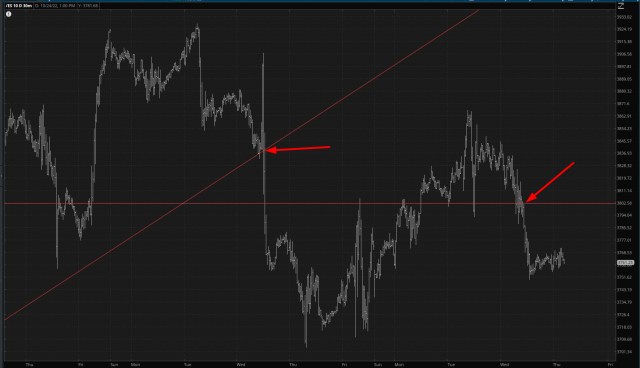

In recent days, two helpful failures for the bears have been, first, the intermediate-term trendline that got busted last week with Powell’s FOMC talk, and second, the slipping below the Fibonacci level yesterday, thanks to the crypto crash. Of course, these could both be rendered moot in a few milliseconds after the CPI, but I am telling you, and myself, don’t regard the initial reaction to the CPI too seriously. If you need living proof of how capricious the market can be, look no farther than October 13th.

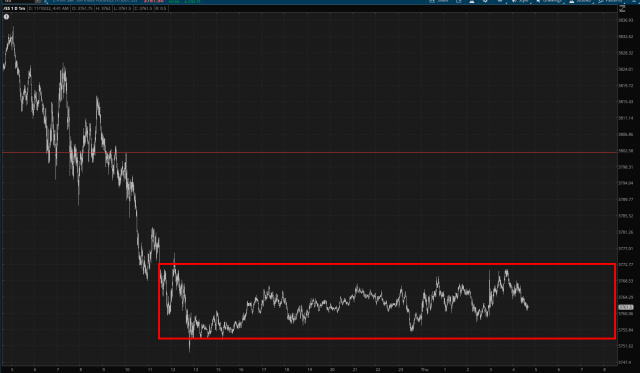

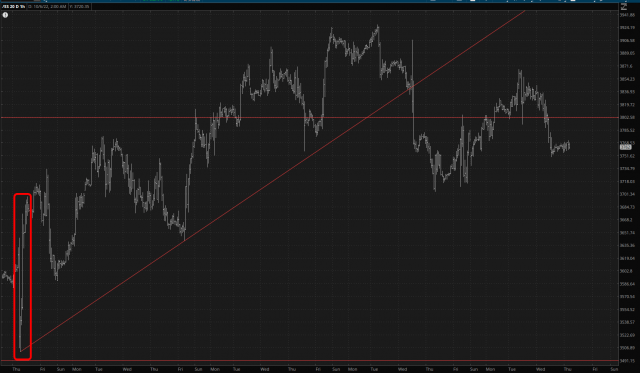

Speaking of that date, I’ve highlighted it below on a longer-term /ES chart. This was a true one-two gut bunch for the bears, because not only did it head-fake them with what initially was a fall to new lows for the year, but it also kicked off a 400+ point rally on the /ES. So, yeah, definitely got some trauma and scar tissue from that one.

I as enter this day, here is the composition of my portfolio:

- 30 bearish positions;

- 29 of them are long put positions on stocks with expiration dates ranging from January 20 (eleven of them) all the way out to April 21st (the other eighteen). The average expiration is 103 days from now, so I’ve got gobs and gobs and gobs of time. I’m reminding myself of this constantly, since an expiration date over three MONTHS from now should give me some peace of mind so I don’t get freaked out about what happens in three MINUTES after the CPI.

- 1 of them is a long put position in XOP, and it is the only one expiring this year (December 16). It also happens to be my largest position, and even though I only entered it Tuesday, it closed the day Wednesday up 61.86%.

- I have over 10% cash.

If the market moves against me, I’ll trim positions which seem the most vulnerable. As my dear mother always exclaimed when I was a child, “Lord have mercy on us all, especially us sinners!“

I’ll see you after the cash market opens. Good luck to us all.