I have not written any posts in quite a while so I want to apologize for my absence. While I have had the occasional comment here and there, I have not felt I had much else to say. I hate politics talk and the charts have been in a choppy zone leading up to this week. But now with both of those issues seemingly put to bed for the year, I think we can get back to good old chart trading.

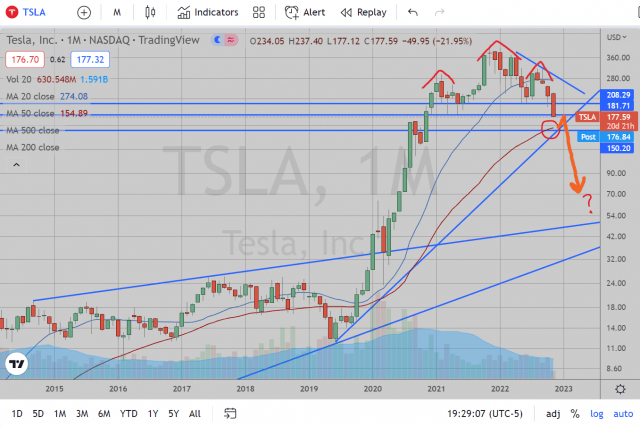

TSLA has been the story of my month/year. This has by far been my most profitable trade ever, I am happy to say. I think there is a bit more left to squeeze out of this lemon in the short term. From a charting perspective, there is a supportive zone between 150-155 and it looks like we could be heading there within the next few days or next week. The technical support I am watching is the 50 Month EMA at 254, the horizontal line around 250 which was prior resistance in October 2020, and finally the ascending trendline drawn from the lows in June 2019 and touching again August and September 2019.

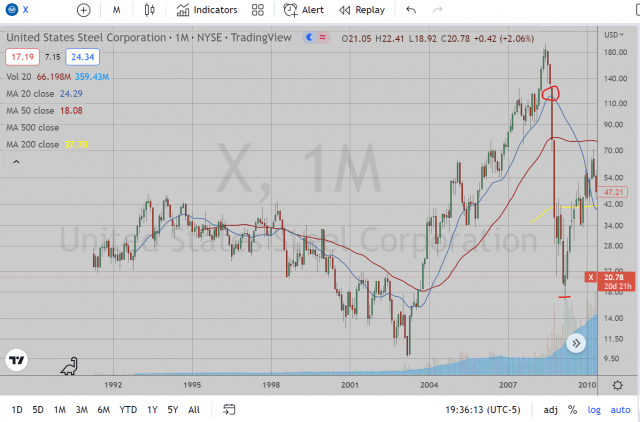

From a fundamental perspective, there could be an argument for this support to fail after an initial dead cat bounce. First, the relative weakness to the broad market has made itself known in the past week. We are finally seeing that weakness when the bigger money is no longer playing the bounces. The 207-208 area was a huge break and 180 was a significant support level since December 2020 which today sliced thru like butter. Second, I am being reminded of the commodities boom in the mid 2000’s which ended with significant technical damage once the 2008 bear market hit.

This is a Chart of X as an example of the type of action which I think is possible. X had an incredible run up from early 2003 to June 2008 from under $10 to $180. But that’s not the part I am focused on. I am focused on the technical break of the 20 Month EMA in August. That technical break occurred at about $120, or after X already lost 1/3 of its value from the peak. After breaking that level, this stock continued to drop until it was beneath $18, or a 90% drop from its peak in March 2009.

Bringing this point back to TSLA, one could argue this stock has had the benefit of its own Boom cycle for tech stocks in the past few years. And now we are seeing this MASSIVE top in TSLA which looks like a H&S pattern to me with neckline at 208. Now, some might say this is a dangerous prospect because it’s “already fallen so far”. But as was the case with X and other commodities and stocks, just because it fell hard already doesn’t mean it can’t fall more.

So where does that leave me? Am I suggesting on shorting the hell out of this thing right now? No, that is not what I am saying. This is what I would call a lottery play. It has potential to work out, but I am not risking everything on this one scenario. I indicated in a comment earlier Wednesday that I am covering part of my position around 180 (we broke through it closed at lows, so I will give it tomorrow before I make that decision). I am then planning on covering 80% of my remaining position between 150-155. That last little 20% bit I will keep in case this just continues to break down immediately (with a stop above $180). If, on the other hand, this follows the path to 150 and bounces to 180, I’ll be looking for resistance and rejection and LOADING UP for this possible crash scenario with a close stop above $180.

I want to end also noting that I have nothing against this company or Elon Musk, his tweets, or his decisions on how to run Twitter, whatever. I have tremendous respect for the way he lived the American dream and built his own company, becoming the richest man in the world in the process. His actions have little impact on my decision on shorting this. I think the chart itself simply warrants a bearish disposition in the short term. Then, given the fundamental backdrop of this boom/bust I described in the Tech industry and seeing how badly it ended for the last boom/bust in commodities, this has a lot of bearish potential. When the building is on fire, I don’t think company fundamentals will be able to prevent the investors running for the door.