Now we enter what could be one of the most exciting trading weeks of the year. It is beginning quietly, with the /ES very modestly adding to its big red number on Friday.

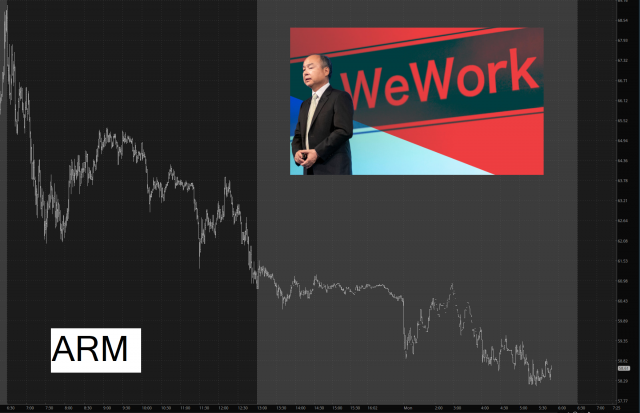

What I’m watching in particular, since it is my largest position, is the semiconductors. I consider it terribly fitting that ARM came public last week. When a nimrod like Masayoshi Son, the genius investor behind wework, trots out a laughly-overvalued IPO, trying to ride what’s left of the NVDA comet tail, you know the end is near. ARM has a terrific launch last week. I strongly suspect it’s going to slowly bleed out for the rest of human history.

If it does, or even if it simply leaks little by little, that’s fine by me. Yes, my XLU position is very big, but my SMH position is even bigger. Plus, for me, it is very aggressive, since it is anchored to October puts, which have a mere 32 days of life left. I have no intention of being in this position longer than necessary, but I definitely have my target in mind and will very likely be entirely out within the next two weeks.

As I enter this new week, I have 13 positions, which are made of 10 equity puts positions (expiring between January 2024 and January 2025) and 3 ETF puts (EWZ, SMH, and XLU). Good luck to the bears out there!