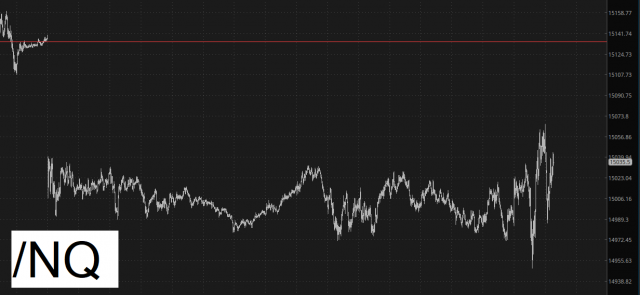

Not exactly an unrestrained plunge, is it? I don’t feel so bad about being so light, since here we are, at the cusp of World War III, and the /ES is down 0.29%. Take note, however, that at least the big equity futures have all stayed persistently beneath their price gap, which was created between Friday’s close and Sunday’s open. If I may say so, I hope it stays under this gap across the board!

I’m having a profitable day, and taffeta-dress-wearing wimp that I am, I dashed out of my short-dated QQQ and SPY puts at the opening bell, so my time risk has again collapsed. In other words, the very closest expiration I’ve got at this point is a full 102 days away, and let’s just all agree a lot can happen in 102 days.

I have expanded my positions from 12 to 15 (having dumped SPY and QQQ but adding 5 new equities), and my cash is now at 18.4%.