As we enter a new week with Yet Another War on our hands, I ponder this targeted demographic’s weighty query………..

My answer is – – what I’ve got right now. In other words, I have WAYYYYYYYY too much cash in my account, which was a result of my running, screeching, with my hair on fire, during Friday’s preposterous run-up. Way, way, way too much cash. The only thing I can say in my defense is that my Premium Post on Friday afternoon called the top pretty much perfectly, so I loaded up on what, for me, is the insanely short timeline of October 20th SPY and QQQ puts, which are going to roar in value at the opening bell.

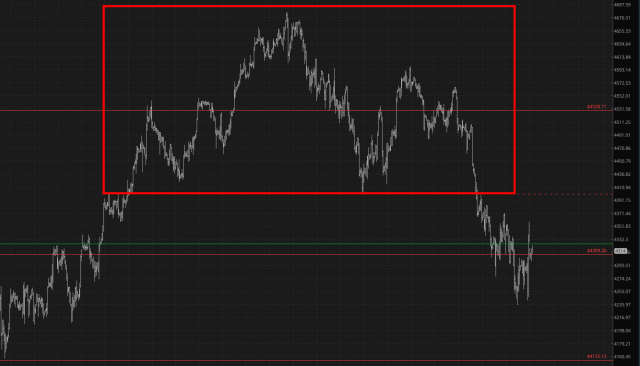

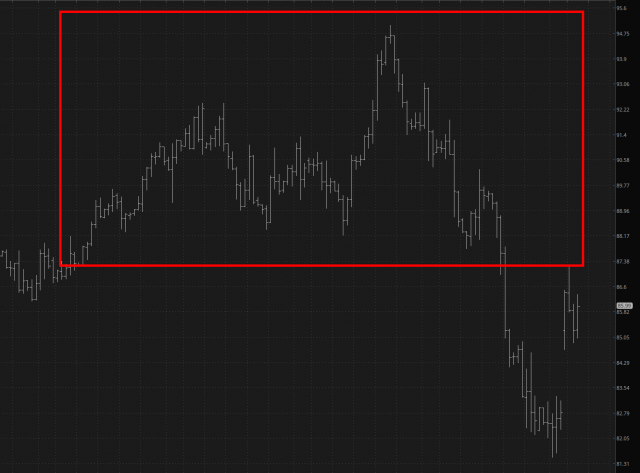

We can see above the price gap from the Hamas attach, and the /ES farted around the FIbonacci ever since. As I’m typing this, the /ES is about about 0.75%, the /NQ a bit more than that, and the /RTY down the most, about 1.2%. Below is the splendid top on the /ES, which the moron bulls figured didn’t matter (actually, I’m sure they didn’t give it a second thought).

The one market which is up strongly is, naturally, crude oil. As your favorite permabear, I only see this as ANOTHER shorting opportunity. Mercifully, I have no energy-related shorts right now, but in my opinion the absolutely SUCK world economy we’re going to have is going to crush oil prices. So this knee-jerk reaction provides another shorting opportunity to use some of the preposterous mountain of cash I have stupidly sitting in my account.

Current portfolio positioning:

- 12 positions, ALL bearish;

- 10 of them expire next year; 2 of them, as mentioned, expire next Friday;

- Cash level is a humiliating 35.4%