I’m starting to wonder what it’s going to take.

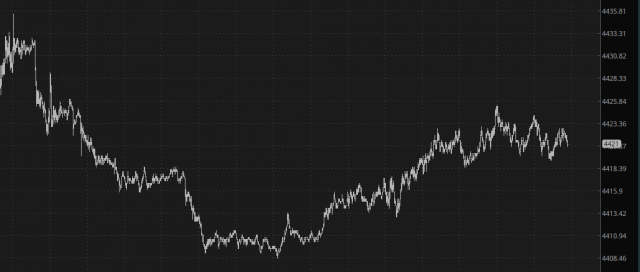

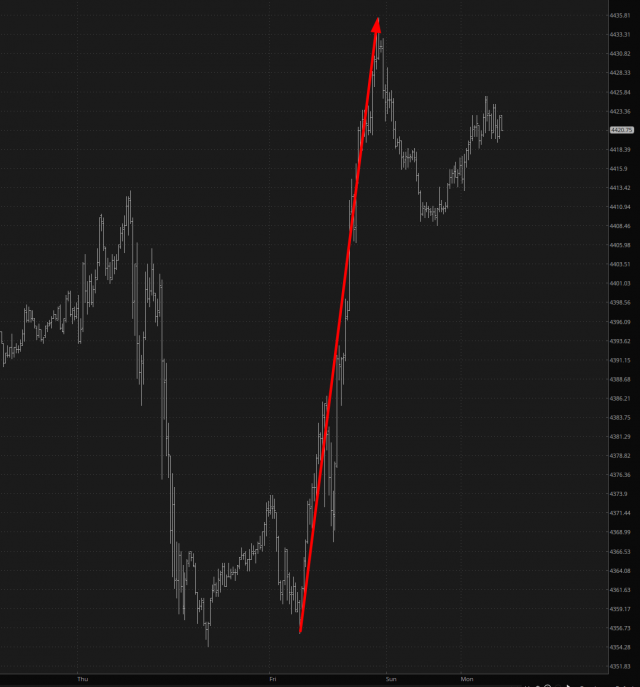

Last night, I was unaware that Moody’s had even put the U.S. on its watch list, and it seems the market didn’t realize it either. The futures opened basically unchanged and ever-so-slowly creeped down for a few hours. Since then, then have erased a portion of those losses, and as I am composing this seventy-five minutes before the opening bell, the potential downgrade of the debt of the United States is crashing the S&P 500 futures by all of one-fifth of one percentage point.

Indeed, in the context of Friday’s mega-rally, this downgrade has only shaved off the final few minutes of the rally. It’s truly become a joke at this point. They should rename the company from “Moody’s” to “Placid’s“.

The VIX, in turn, has exploded from a 14-handle to a 15-handle. Whoop-de-freakin’-ding-dang-do.

Perhaps no one cares, since the politicians ALWAYS find a way to kick the can down the road, and yet another Continuing Resolution would, I suppose, dispense with the prospect of an actual downgrade. I find it altogether fitting that the proposal from the new House Speaker is a stopgap spending bill which would extend the government’s budget from this Friday until…………I am not making this up……….Groundhog Day.

In any case, it is clear in recent weeks that the GLOBEX has kind of stopped mattering, since the market will do whatever it wants the moment the cash market opens. Let’s wait and see what the personality of stocks is once that happens.