Here are some charts of companies Spruce Point Management has identified as having some issues ranging from poor management to shady accounting. The firm describes itself as: a New York-based investment management firm focused on research driven short-selling, value and special situation investment opportunities. Since inception, Spruce Point has released more than 100 forensic short reports on companies across a diverse range of industries, market capitalizations and geographies. Spruce Point’s investment approach is predicated on changing investors’ perception of a company’s value through the public sharing of new information or variant points of view. The Firm’s mission is to challenge the Wall Street status quo where conflicted analysts overwhelmingly issue glowing “Buy” recommendations.

Some of their targets have been consistent losers such as NVEI and OTLY. Others such as GNRC could have farther to go, but they’ve hit the firm’s target. What I’m interested in are companies that have bucked the trend, but perhaps only because of a rising tide lifting all the boats. Some of these companies might have solved their issues, but some likely have not. All I’m looking for here is a little edge on top of any charts that look promising. Maybe they’ll have the extra oomf to go from a decent short to a great one.

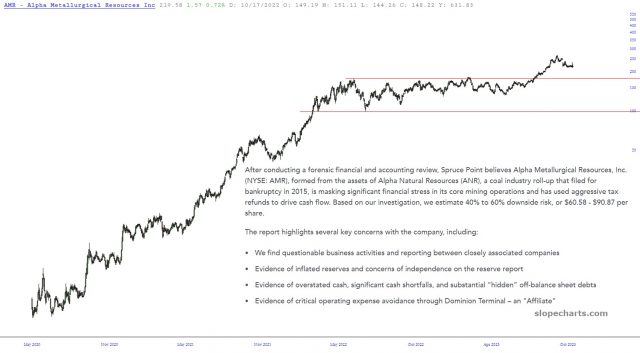

I live to eat my vegetables first, so here’s their “worst” call thus far in terms of how the stock performed: AMR. The post-2020 central-bank-a-thon along with stimulus, green regulations and then Russia sanctions made coal valuable again. Are the company’s problems gone, or merely papered over for now? The AMR report is from May 2022.

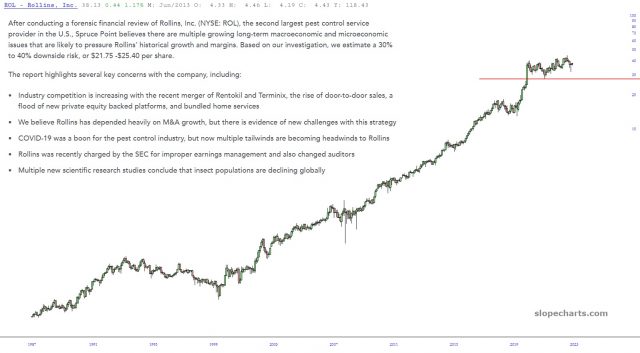

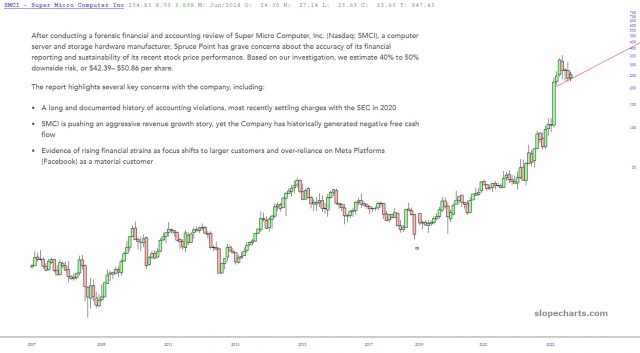

Others that haven’t cracked include the following. Full reports are available at Spruce Point’s website . I make no endorsement of the reports. I merely keep track of charts that short-sellers have targeted in the past.