For the first day since Thursday last week, the lower bollinger band on SPX was not touched as support yesterday and that looked like a clean break towards the upper bollinger band. That's currently just above the 1340 resistance level and I would normally at this stage expect that to be touched, or close to it, before seeing another break below the middle bollinger band:

In terms of the pattern setup the possible bearish H&S on SPX died yesterday and can now be disregarded. I was asked yesterday whether a break up at this stage would invalidate the IHS and the answer to that question is no. The right shoulder is now deep enough to qualify, though symmetry is not ideal. Have a look at the IHS at the low in 2009 to see an IHS with worse symmetry on the right shoulder that nonetheless made target. if SPX breaks over 1335 area resistance then I would consider that an IHS neckline break:

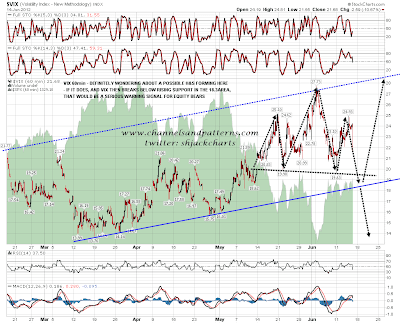

The possible H&S on Vix is still forming and has actually followed the arrows I drew earlier this week to show the ideal path almost exactly. The right shoulder peak was just under the 25 level I was looking for. I am definitely taking this pattern seriously:

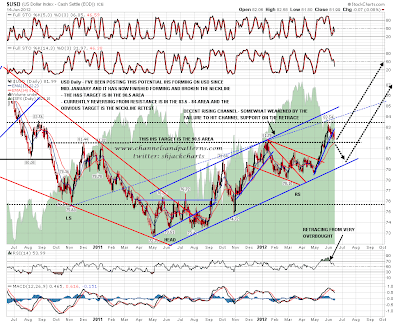

I wanted to have a look at USD today. Three weeks ago I was looking for a possible reversal at 83.5 to 84 area resistance to retest the IHS neckline in the 81.6 area. It peaked at 83.54 and the low since then has been 81.73. It is therefore entirely possible that USD is now bottoming out here. I am wondering about further USD weakness however looking at some currency pairs, and I've added an option to consider if USD breaks back below the IHS neckline. There is a decent rising channel on USD and some of you may recall that my ideal target for the right shoulder low on USD at the lower channel trendline was never hit. It is possible that we might see that hit on this retracement:

Looking at some of those currency pairs I can see a nice looking IHS forming on CADUSD that would need to break up shortly if it's going to break up. The target would be in the parity with USD area:

I was also looking at the Yen chart. The fundamentals for the yen really stink. Debt to GDP is an astounding 210%+, and one in three yen spent by the government is new borrowing, or more accurately, new printing. Incredibly the yen is still a popular flight to safety destination but the long term chart setup looks ugly. A rising wedge formed from the 2005-7 lows broke down earlier this year, a sloping H&S is forming, and made the ideal right shoulder high two weeks ago. The downside target would be in the 105 area. If the yen remains a flight to safety destination then this setup would normally look bullish for equities and bearish for USD. We'll see how that goes:

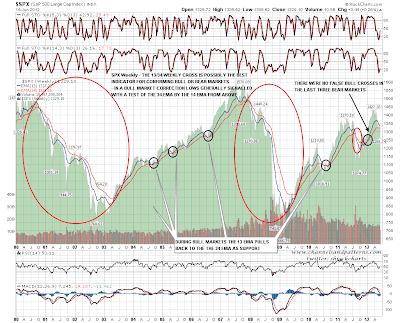

I've been saying often that I don't think we've seen the final low for this correction from the highs, if it is a correction. I have a number of reasons for thinking that and I'll show you one of those on the SPX 13/34 Weekly EMAs chart. This is perhaps the best indicator for bull and bear markets over the long term but it's also interesting during bull markets particularly, as corrections end more often than not with the 13 EMA testing the 34 EMA. This isn't always the case but you'll note from the chart that the only occasions where it didn't happen since 2000 were while SPX was forming major tops. Thought for the day:

Someone commented earlier this week on Twitter that opex weeks often follow a pattern of closing up and down on alternate days. That has been the case for the last five days and if that holds then we'd be due a down day today. The Greek election is Sunday, and the pro-bailout/austerity parties may well lose. That could be a huge market mover, very possibly downwards, and might well limit any upside today.