Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

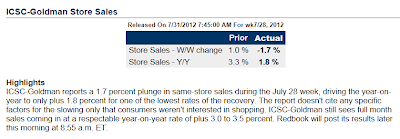

Consumers All Shopped Out Amidst Rising Prices

Data for Store Sales released today shows that consumers reigned in their spending for the week, "driving the year-on-year to only +1.8% for one of the lowest rates of the recovery."

This was is spite of a rise in Personal Income for the month, while the price of goods (and housing) rose. Perhaps buyers are waiting for "back-to-school" sales before they part with any extra cash…or even paying off debt.

So far today, the credit card stocks are down from yesterday's close, as Visa pulls back from yesterday's all-time high…ones to watch for any further weakness developing.

Baker Hughes Begging to be Shorted

At Least They Still Have Their Good Looks

Rolling Over (by Springheel Jack)

Just for a change of pace I'll mainly be using futures charts today. Not much to add to yesterday's charts on SPX with a doji at the upper bollinger band on the daily chart, and the rising wedge I showed on the 15min chart has now broken the support trendline as expected.

Rising support has also broken on the ES 60min chart on strongly negative 60min RSI divergence. If you look at the last couple of months on the chart you can see that these divergences have been a very good signal of a coming reversal: