I hope everyone is enjoying the weekend. It is beautiful here in SoCal and I will be a beach rat this weekend. Last week my trades worked out just fine with two frustrating stop outs at break even that eventually climbed right back up,and one beautiful day trade before earnings (AMZN, DO, and QCOM respectively). My other trades are still active or were weekly spreads that expired.

Energy has been a beast, and we may get some rest next week ( I wonder what it is sniffing out; war or QE?) The currency metals are simply not wanting to go down anymore, but I am still mostly writing spreads and day trading GLD with weekly calls and puts.

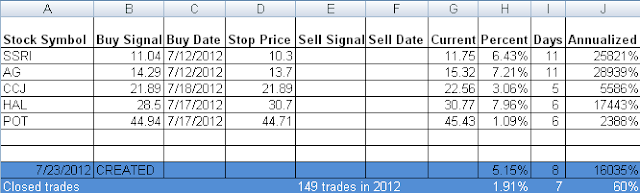

I am also still short FAS and SPY, although I took off half of SPY on Friday's close. FAS broke its bear flag channel, and I am expecting FAS to be in the 60's soon enough. I also am going to short PNRA and CMG on all rips when stochs go OB. Higher energy, higher food, higher taxes, and zero wage growth is a recipe for disaster for these companies. Grocery stores are dying and people need that stuff, wait until these restaurants try to pass these higher costs along. Below is my current active trades, and Y_T_D results, and some charts to enjoy.

www.arum-geld-gold.blogspot.com