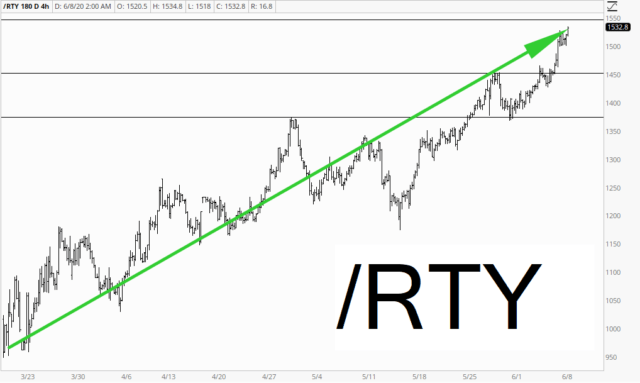

As ZH aptly put it, “the melt-up continues”. The rise in small caps since the end of the shortest bear market in history (one freakin’ month) has been merciless:

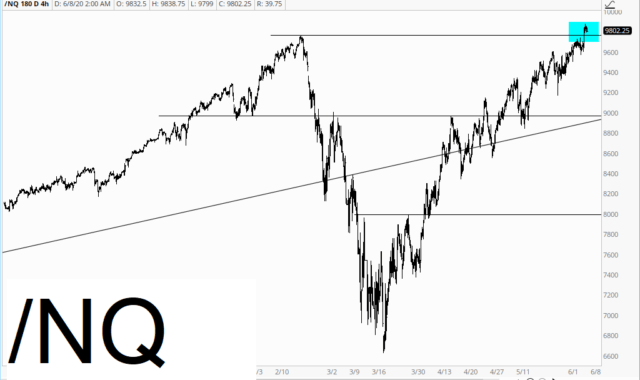

Tech stocks already busted into lifetime high territory last week, although recently they seem to not be matching fire quite as easily as other sectors.

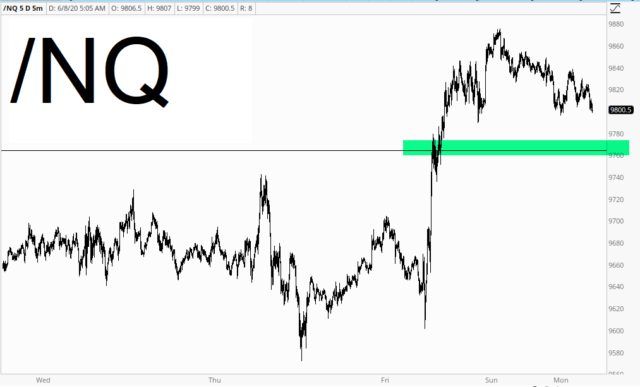

Looking more closely, you can see the NQ is actually selling off (for the moment, at least). I’ve tinted in green the “breakout to lifetime highs” zone. It isn’t particularly important, but if we slip below it, it’ll at least mean a failed bullish breakout.

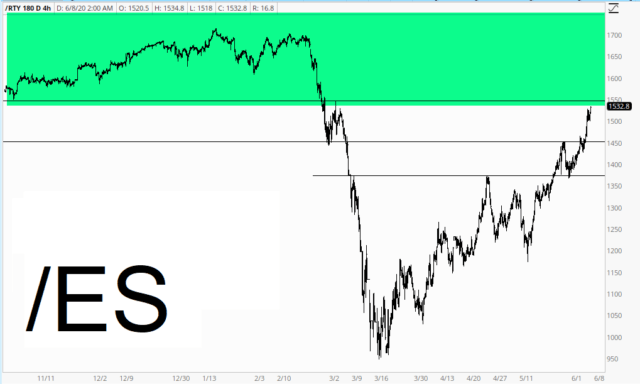

In the middle of red-hot (small caps) and not-so-hot (NASDAQ) is the S&P 500 futures, by way of the ES. Most indexes have gone up nearly 50% in just a few months, although we have reached a point of tremendous overhead supply.

All of the above is, of course, courtesy of the Fed’s trillions of Powell-bux and not any actual news or events. The one area of the economy that actually did have news is crude oil, since the OPEC nations agreed to extend their production restrictions. This resulted in a spike (green tint) which has burned off already. I would also note that crude oil did a squeaky-clean job of sealing up a major price gap dating back to March 6th.

I spent a good part of the weekend giving the entire Slope site a thorough going-over, since our development efforts are accelerating. All I can say is that the site has, over the years, become much more vast and complicated than I dared to think. I’m a neat freak, though, so you’re in good hands. This place is just going to keep improving, and it’ll do so in an orderly fashion.