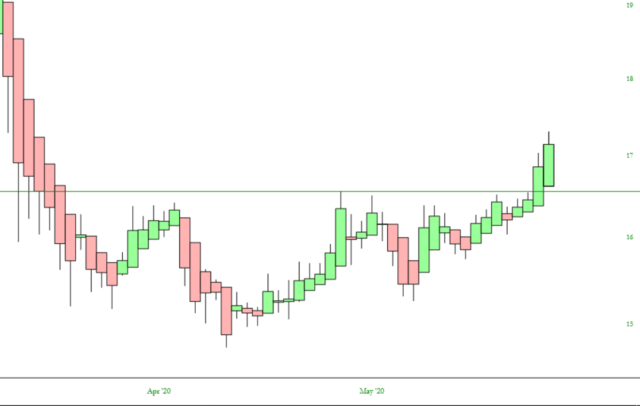

The airlines have been going absolutely ape lately. American Airlines doubled in price in the span of three weeks (incredible, yes?) Take a look at these three examples of larger passenger airlines. You can see the similarities.

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

The airlines have been going absolutely ape lately. American Airlines doubled in price in the span of three weeks (incredible, yes?) Take a look at these three examples of larger passenger airlines. You can see the similarities.

I’m pleased to let you know of another entry into the SlopeCharts technical indicators library, which is the Average True Range (ATR).

The average true range (ATR) indicator appears in a pane of its own and indicates increasing or decreasing dynamism in a security’s price. Unlike some indicators, its ascent and descent have nothing to do with strengthening or weakening prices, but instead illustrates volatility.

The reason for this is the calculation for ATR is based on its dollar price range (either the difference between a day’s high and low or, when appropriate, the difference between the day’s high and prior close or the day’s low and prior close). The average of these values is the basis for the line chart drawn, and the default value of 14 days is the suggested value of the original creator of the study, Welles Wilder.

(more…)ValueWalk held its second Contrarian Investors Virtual Conference, and Grizzly Research Founder Siegfried Eggert is pitching Hebron Technology Co Ltd (NASDAQ:HEBT) as a short. He believes Hebron is an “insider enrichment scheme without economic basis.”

In his presentation, Eggert noted that Hebron Technology’s stock has skyrocketed following recent private placements and acquisitions. He believes the company is running an insider enrichment scheme. He also said all of last year’s major transactions were “announced and portrayed as arms-length,” but the Grizzly Research team was able to link all of them back to company insiders.

(more…)As mentioned yesterday in my Bonds Away post, the TLT had cracked support, thus completing the bullish pattern for TBT. It continues today, even stronger.

We are continuing to polish the Slope Mobile product, and I wanted to mention something about this particular feature: