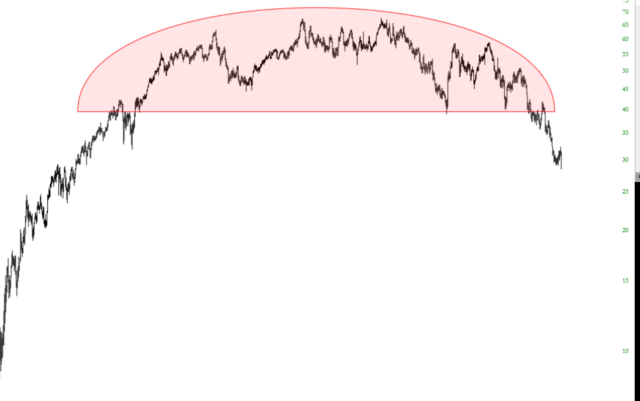

You would think it had all caused me harm, what with all the fuss I made about the market’s rise. It’s just the insanity of it all, though. And I’m not trying to be a drama queen. Or king. Or any kind of emotional royalty. This has simply been insane. And that is a word I freely use, even having lived through the mayhem of 1999/2000.

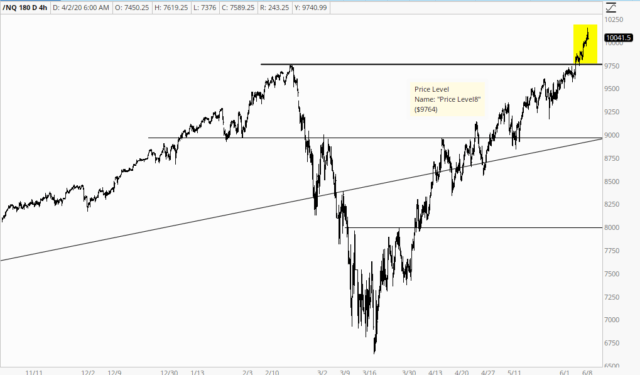

The NASDAQ, of course, slipped right over the Big Round Number of 10,000, and the permabulls couldn’t be happier. Sort of like the effect the Big Round Number of 5,000 had back in March 2000, just before the 83% collapse.