If there’s one consistent reaction the public has to the stock market these days it is confusion. Whether bull or bear, people watching the stock market over the past three months can hardly believe their eyes. Most of them are thrilled, of course, since the so-called market seems to be virtually printing money, even in the face of horrible economic and social problems, but hardly anyone is arguing with it.

For instance, if my house in Palo Alto increased in value 5%, month in and month out, without any apparent rhyme or reason, that would be just fine by me. Would the utility of my house have increased? Would its appearance have improved? Not at all.

It would simply be worth more, and my net worth would increase, while simultaneously those who wanted to own a home in Palo Alto would be farther and farther away from their goal. The wealth disparity – – measured, in this case, in residential housing – – would be getting worse. I’d be happy. Non-home-owners would not.

Precisely the same thing is happening in stocks lately. The companies behind the stocks aren’t doing well; on the contrary, corporations are up to their necks in troubles. In spite of that, the shares that are already owned simply keep increasing in value, apropos of nothing, and the financial spread between the “haves” and the “have nots” does nothing but get wider.

The one and only reason for all of this, of course, is the Federal Reserve. Anyone who tells you otherwise is either a political hack or utterly clueless. And, given this fact, I have recently found it very helpful to look at stock values through a very different lens. Specifically, the lens of money supply.

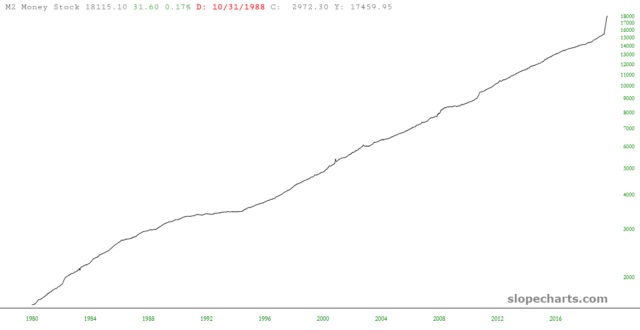

Let’s take a look at the long-term trend of the United States M2 money supply. As you can plainly see, it has been in a persistent uptrend for decades on end, not dipping even a single time. The principal characteristics of this growth is the angle of its ascent. As of March 2020, the money supply growth went from Steady to Insane.

So with all of these trillions raining down upon America, the economy must be hotter than a two-dollar pistol, right? Well, the data from no less a party than the Federal Reserve itself provides an answer in the form of money velocity.

Here, over a period of many decades, is a different representation of M2. Instead of the supply of money, this chart shows its “velocity” (that is, if money is the blood of the economy, this chart suggests its heart rate and blood pressure). The chart doesn’t exactly scream “booming”.

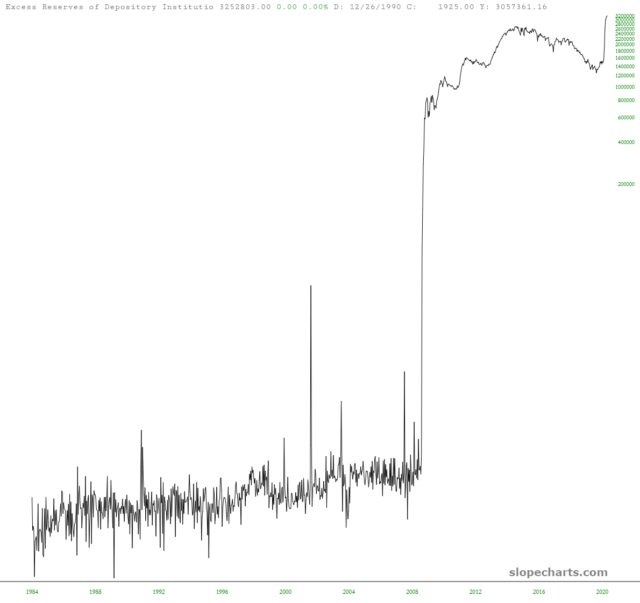

So, wait, where does all those trillions wind up, if not ricocheting between you, your shoe retailer, your grocery store, your accountant, and your yacht salesman? Well………….the banks, maybe? After all, since the Federal Reserve is a private corporation owned by the banks, they’re a fairly chummy lot, and the chart below of the Excess Reserves at these banks does a nice job illustrating where the cash is stashed.

With all this in mind, there are just two assets whose charts I would like to show, each of them modified simply by dividing their value by the (ever-growing) M2 money supply. I think these new charts, benefiting from being displayed with a more realistic respect for just how much “money” is sloshing around out there, offer us some helpful hints.

The first is gold, and the chart is a stunner. What we have here is a beautifully-formed saucer pattern, which is a bullish base for what should be a very substantial ascent.

This is a slow, plodding pattern measured over the span of many years, not weeks, so gold could be subject to plenty of ups and downs in the months ahead. All the same, as a long-term chart, gold (expressed proportionate to the common fiat money used in society) looks simply dynamite.

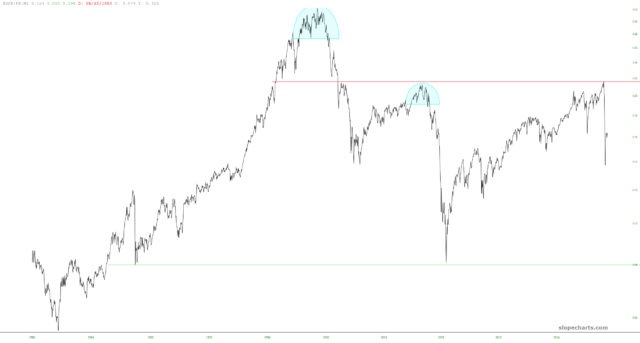

Stocks, which recently have been either at lifetime highs (like the NASDAQ) or only a tiny bit below lifetime highs (like the S&P 500) present a new, more helpful picture when “subjected” to being divided by M2. Take a look at this S&P 500 chart after such a modification:

What seems evident here are several things:

- The true “top” of the market was early in 2000, and we’ve never come close to matching it;

- The peak in 2007, prior to the financial crisis, was the new upper limit for equities, and prices stopped at a “ceiling” which had been the “floor” of the Internet bubble preceding it;

- The peak in February 2020, after countless trillions of dollars had been hurled through various programs since 2008, accomplished nothing except to match the exact same 2007 peak.

Putting it more simply, stocks are expensive at the red line and cheap at the green line. This “cheap” level has only been tagged twice: once after the crash of 1987, and once at the nadir of the 2008/2009 financial crisis.

As you can see from present price levels, we are far away from being cheap (it should be noted that this chart doesn’t even captured the most recent strength in stocks, which puts the most recent price nearly 10% higher than represented above).

My overarching belief is that the stock market has, from the early 1980s to the present, changed utterly and irrevocably in character from, in the past, a mechanism for capital creation and price discovery into, in the present, a political tool, little different than a propaganda poster from North Korea. It’s a shame.

:format(webp)/cdn.vox-cdn.com/uploads/chorus_image/image/58251699/Latest_Propaganda_1.0.png)