Despite all the buzz in the name First Solar (FSLR), I’ve stayed away from it until now, because I didn’t consider implied volatility to be cheap for the scenario at hand. Now, however, I do see some attractive plays that I intend to make use of.

First, I want to point out that maturities out to Dec 2013 have a pronounced volatility smile, where upside strikes are offered at a higher implied volatility than near-the-money strikes. This is different from the SPX, where smile is very weak on the upside and doesn’t kick in until very far OTM.

If you go out to March 2014, however, vol surface is basically flat, and out to Jan 2015, it’s actually a standard equity vol surface with upside strikes offered at a discount to ATM. So, purely on a vol basis, Jan 2015 is most attractive for vol plays.

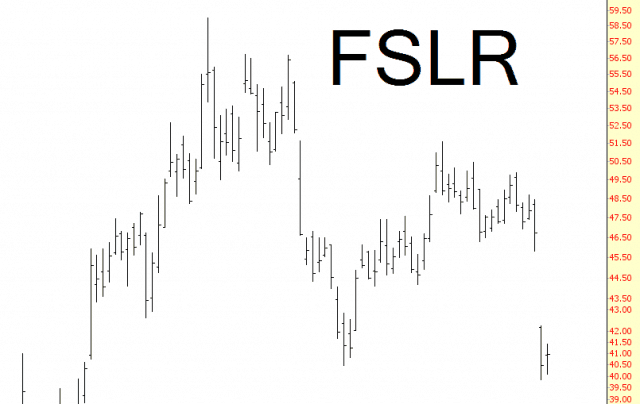

One needs to decide whether they are looking for asymmetric plays with full premium at risk, or if they are looking to trade it like they would a stock, with a stop (which, let’s assume, would be the $35 lower bound for wave ii on the chart).

In case of the latter, I like Jan 2015 calls with strikes in the 60 to 70 range.

In case of the former, it’s a bit more tricky because you need to figure in expected timing. What I will be doing is waiting patiently for a c-wave down to complete (I see FSLR as currently only having completed wave iii of c, and still needs a bounce in iv towards 44 before another low closer to 35), and then go for the gamma play with October calls, strikes 50-55.

Originally published on ElliottWaveTrader.net, by Xenia Taoubina.