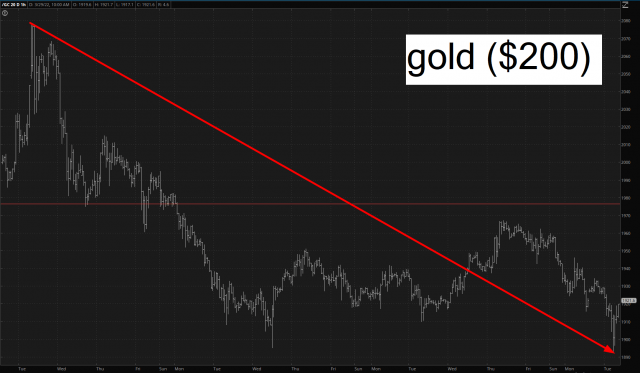

Most of you know that just about the only thing that got “nuked’ with the Ukraine conflict was safe haven commodities, such as gold, which lost $200 per ounce in short order.

In some countries, however, this drop has been rendered moot since their own fiat currencies are even worse. The shining example of this is the Yen, the country of a senior citizens colony known as Japan which is hopelessly mired in debt and has a shrinking working population supporting a ceaselessly-growing base of the elderly. The bottom line is that the Yen is toilet paper.

As such, gold as measured in Yen terms (thank you, Gartman!) is doing just fine and dandy, thank you very much.

One wonders if the day will come that the United States has a similar situation. I will say, even in U.S. terms, the overall bullish formation of gold is undamaged.