Two Years Of Gold Bugs Getting Burned

In an article last week (“Gold: A Sucker’s Paradise“), ETFguide editor Ron DeLegge noted the illustrious list of hedge fund managers who have gotten burned over the last two years being long gold and related securities such as the SPDR Gold Shares ETF (GLD). One hedge fund manager who’s been on the right side of the gold trade has been our host Tim, who mentioned on Tuesday that GLD was his largest short position (“Repeating My Target for GLD“).

GLD is down about 30% over the last two years, but gold miners have done even worse. The Market Vectors Gold Miners ETF (GDX) is down more than 60% over the same time frame. Nevertheless, GDX closed up fractionally on Wednesday, and the triple-levered mining ETF Direxion Daily Gold Miners Bullish 3x Shares (NUGT) closed up 1.05% on the day. In this post, we’ll look at a way the brave souls buying NUGT can get paid to limit their downside risk.

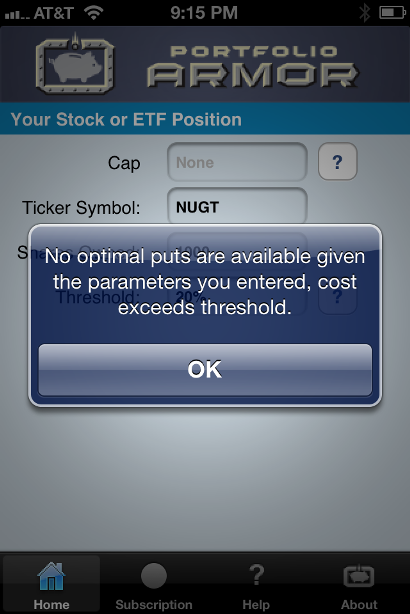

1) Hedging With Optimal Puts

Uncapped upside, but unavailable in this case.

As of Wednesday’s close, it was too expensive to hedge NUGT against a greater-than-20% drop over the next several months with optimal puts* (i.e., taking into account the cost of the put protection, it wasn’t possible to limit your losses to no greater than 20%). This is pretty common with triple-leveraged ETFs, as the volatility means higher options premiums.

Because of that, we were presented with the error message above.

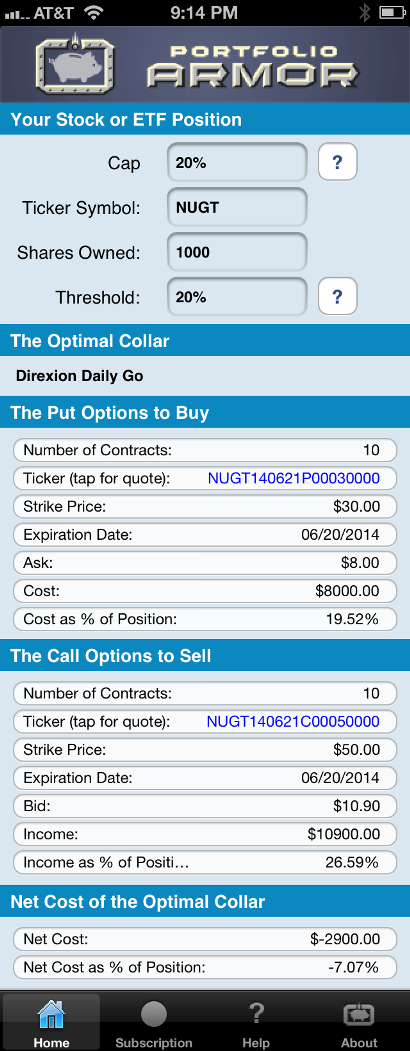

2) Hedging With An Optimal Collar

Pays you to hedge. 20% upside cap.

If you were willing to cap your potential upside at 20% between now and June 20th, this was the optimal collar** to hedge 1000 shares of NUGT against a greater-than-20% drop over the same time frame.

As you can see at the bottom of the screen capture above, the net cost of this collar, as a percentage of position value, was negative, meaning you would get paid to hedge. The high premiums on the short call leg more than offset the high premiums on the long put leg of this collar.

Note that, to be conservative, Portfolio Armor calculated the cost of this hedge by using the bid price of the call leg and the ask price of the put leg. In practice, you can often sell calls for more (at some price between the bid and ask) and buy puts for less (again, at some price between the bid and ask), so, in actuality, an investor opening the optimal collar above may have paid less than $2900 to hedge in this case.

Possibly More Protection Than Promised

In some cases, hedges such as the ones above can provide more protection than promised. For a recent example of that, see this post about hedging shares of Tesla Motors, Inc. (TSLA).

*Optimal puts are the ones that will give you the level of protection you want at the lowest possible cost. Portfolio Armor uses an algorithm developed by a finance PhD to sort through and analyze all of the available puts for your stocks and ETFs, scanning for the optimal ones.

**Optimal collars are the ones that will give you the level of protection you want at the lowest net cost, while not limiting your potential upside by more than you specify. The algorithm to scan for optimal collars was developed in conjunction with a post-doctoral fellow in the financial engineering department at Princeton University. The screen captures above come from the Portfolio Armor iOS app.