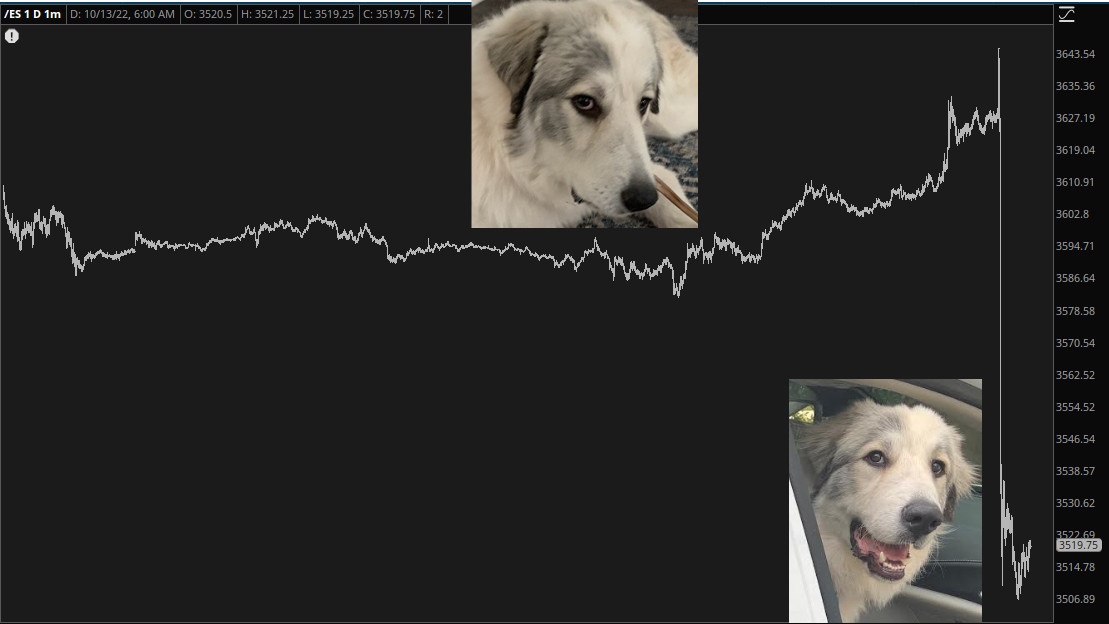

The market is a cruel, cruel mistress, but surely the cruelest in years (for me, at least) was the plunge the market took on October 13th on the heels of the hot CPI report.

At the time, I was terribly excited (for obvious reasons). To my credit, I had the good sense to recognize a major price target had been hit. To my everlasting shame, I didn’t do a damned thing about it.

So here we are, a full eight months later. Eight agonizingly long months. The market has done nothing but go up. Stocks up are hundreds of percent. Even huge companies like TSLA have vaulted higher by triple digits, with today being the TWELFTH DAY IN A ROW of price ascendency.

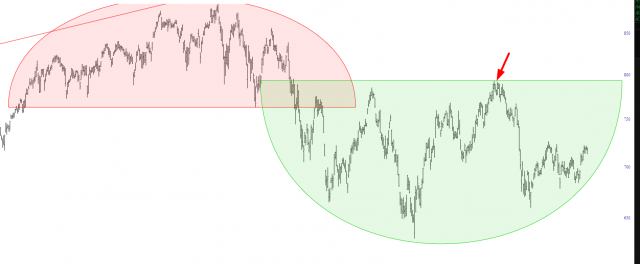

It seems to me the “Face-Off” we’ve been following may well have resolved in the favor of the bulls. If, by end of day Wednesday, this still seems to be the case, the bears may not see the light of day for months to come. Here we have the All World Index.

The semiconductor index is even stronger, roaring to nearly lifetime highs:

The NASDAQ Composite, of course, has likewise broken out from a strong base.

And, back to the basics, the S&P 500 has a similar base and has clear even its mid-August peak.

Just about the only hope the bears have at this point – – and I ain’t countin’ on it – – it the same kind of failed bullish breakout that financial stocks experienced months ago.

For me, personally, the stakes are terribly high. When the stock market is crumbling:

- My portfolio value soars;

- I get flooded with subscriptions;

- My disposition and emotions are absolutely sunny

When the market is ripping to new highs constantly, the exactly OPPOSITE occurs on every one of these parameters.

To preserve my sanity, I have been maintaining a sizable cash balance. Probably the most constructive thing I’ve done recently is put together a spreadsheet of my beloved son’s Tesla options packages. It’s comforting to know that ONE Knight clan member is getting rich, because it sure ain’t me!