There will come a day when we (or at least I) will look back on this era and be amazed we got through it. Seriously, this is a drag deluxe. The government has made these markets untradeable except for buy-and-hold-tech-forever types. It’s honestly suffocating.

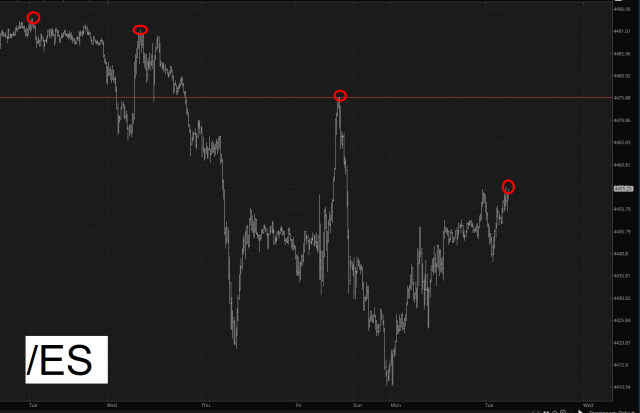

On that cheerful note, let’s take a look at these “markets” as we mark time, waiting for tomorrow morning’s CPI fiction. Over the past week, the /ES has slowly been working its way slightly lower in a series of lower highs.

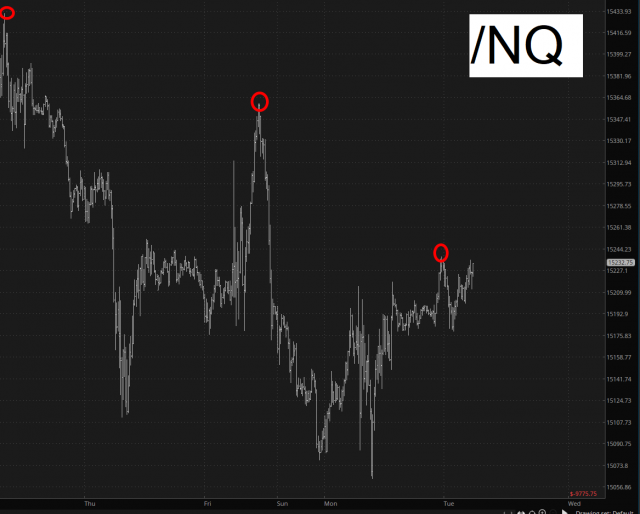

The same has been seen with the /NQ.

In contrast to this, the small caps (and banks) have been surging lately.

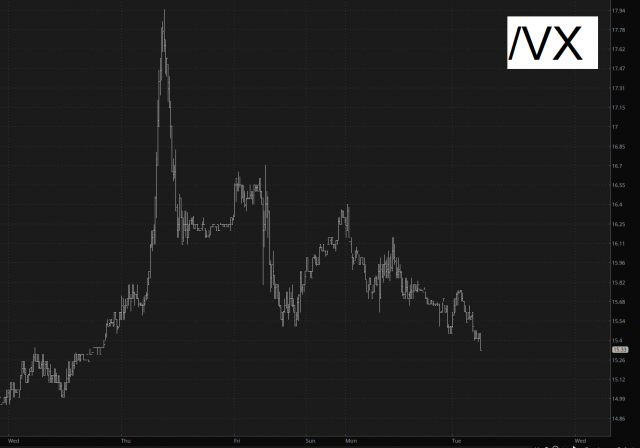

Tiny dips notwithstanding, the fact is that the market is becoming ungodly boring, and after a little bit of a pulse last Thursday morning, the VIX futures have once again been smothered in their crib.

So the obsession with the CPI seems based on this hare-brained narrative:

- The CPI will show, yet again, inflation is dropping;

- Therefore the Fed will not only stop raising rates, but will start dropping them;

- Thus stocks will go to the moon, just like in 2020-2021

And that’s really all there is to it. In any case, I’m staying ridiculously light until, ya know, something – – anything – – happens.