So here we are. Right in the thick of the biggest earnings week and only hours away from the latest Kabuki theatre from Mr. Jerome Hayden Powell. It’s the 5th FOMC of the year, folks, and the big question is – – – 0 or 25? I think the bigger question is……….what’s the reaction? Because the actual decision doesn’t really seem to matter.

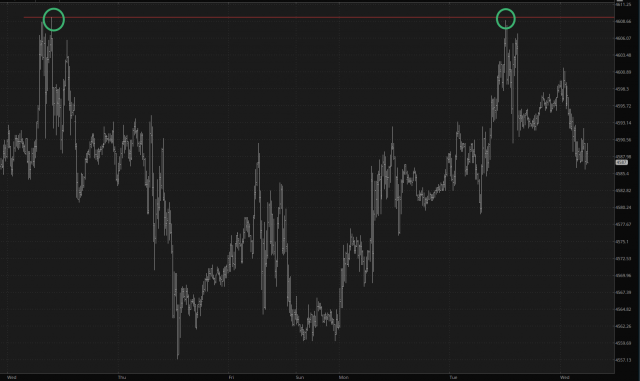

Half an hour before the opening bell, all the equity futures are in the red. Yesterday the /ES went absolutely roaring higher for no discernable reason, and it was interesting to see the drivers of this thing slam hard on the brakes the millisecond we reached last weeks’ peak (two green circles). Now we’re meandering around again in no man’s land, with the decision whether to break above or below this range looming before all traders.

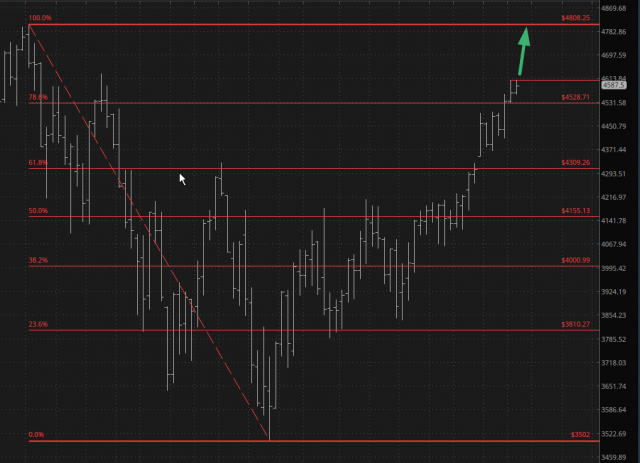

Looking at the longer-term picture, the obvious direction is UP. It’s obvious because we’re poised for it. It’s obvious because 99.9999999999999% of humans are permabulls. It’s obvious because 2023 has been NOTHING but a bullish year, from end to end. And if we push past the aforementioned green circles, it will also be obvious I’ll be very bummed! But I’m not going to pretend the chart below isn’t bullishly configured.

One crucial item which I think could inform equity prices in the weeks to come is bonds, which have been in their own bear market for well over 3 years now (how I wish I could say that about stocks!) Three years! Can you imagine? Anyway, if the /ZB can break the green line below, yeah, we can all look forward to even HIGHER interest rates and a more quickly-suffocating economy.

This is all adding up to what’s going to be an awfully, awfully interesting election 16 months from now.