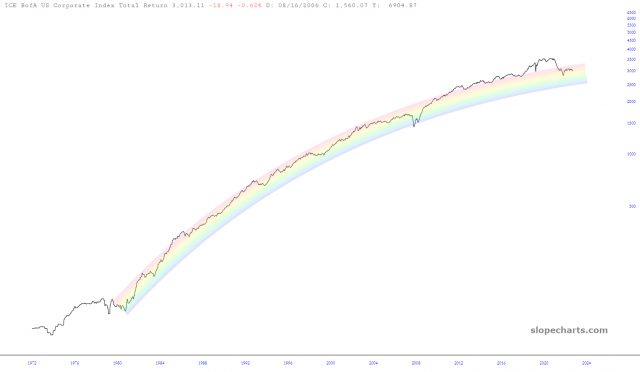

Here is the long-term corporate bond total return index. Bonds perform well, but they start losing steam in the 2010s as interest rates are suppressed. The Fed slashed rates into 2020, then spiked them. Investors holding corporate bonds lost all profits back to 2016 at the 2022 low.

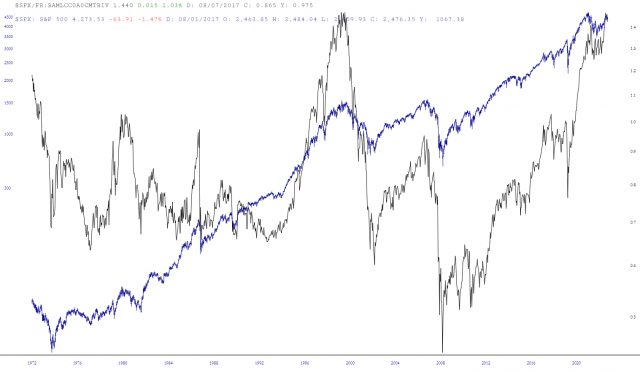

Here’s the ratio of the S&P 500 to the corporate bond total return index. You might notice there are spikes around some familiar dates…

Here it is layered with SPX. Every bear market or major correction: 73/74, 80-82, 1987, 2000 and 2008 all came with the ratio at 1000 or above. The only comparable level from the past 50 years to today’s level was the 2000 top.