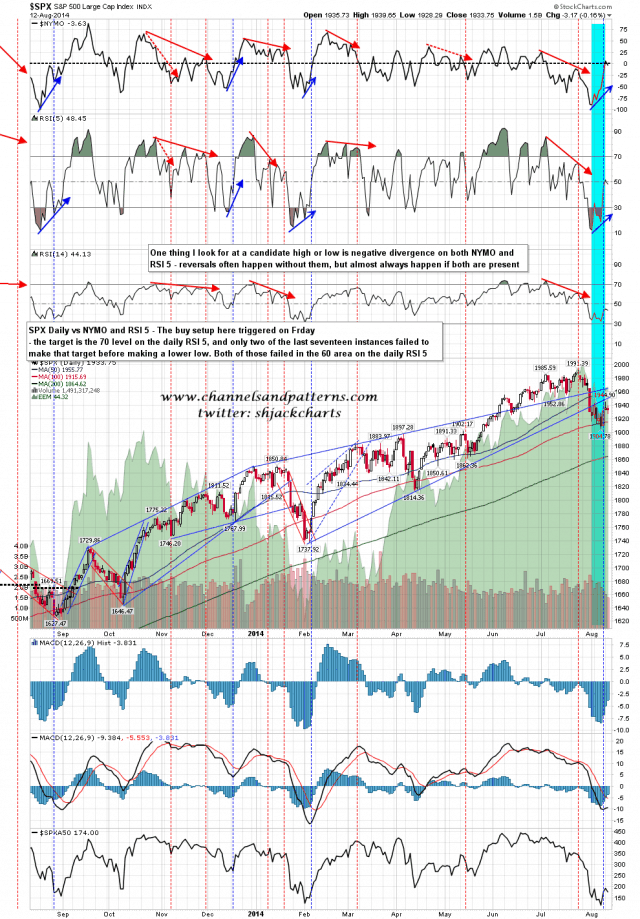

This is going to be my top chart every day until the daily RSI 5 hits 60. Over the seventeen buy signals from this chart back to the start of 2007, fifteen made the signal target at the 70 level on the daily RSI 5 and the two failures both failed above the 60 level. As ever there’s no guarantee that this time won’t be different, but the short side is very low probability historically until the daily RSI 5 hits 60, at which point shorts will be upgraded to just low probability until it hits 70. The RSI 5 high so far on this move is just over 50. SPX daily vs NYMO and RSI 5:

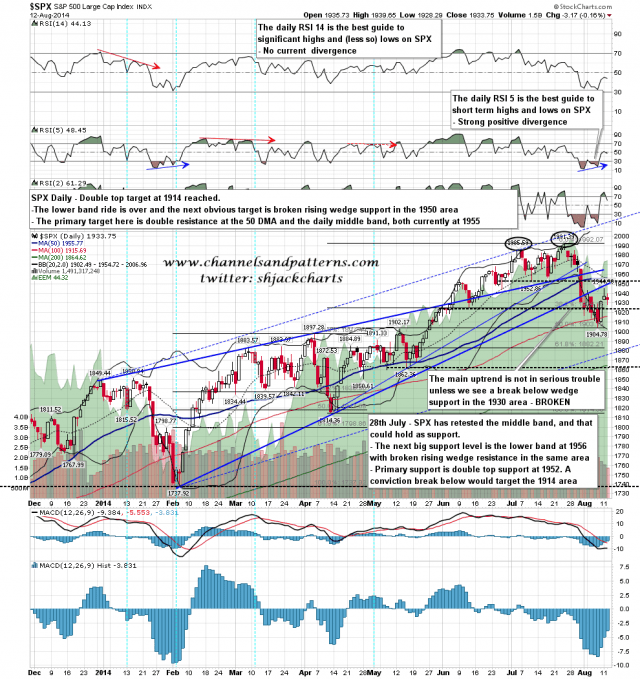

On the daily chart there is some resistance in the 1950 area at broken rising wedge support but the main short term target is double resistance at the 50 DMA and middle band at 1955. Bulls need to get back over those levels to regain control of this market. If we are to see a reversal back down then the chances are that it will be at that test. SPX daily chart:

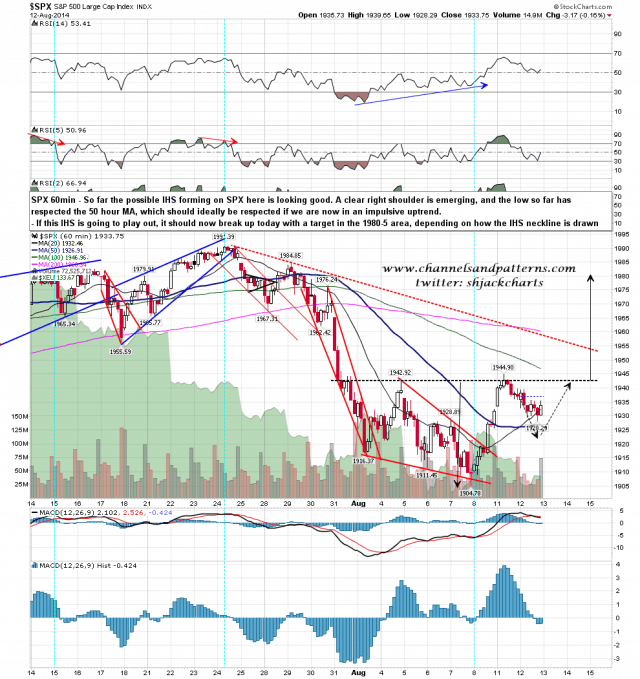

Given that the bulls still have the overall strong buy setup from the top chart in their favor, the shorter term setup looks very nice indeed. The IHS right shoulders that I was looking at yesterday morning on SPX and RUT both formed nicely and those patterns would need to complete forming and break up today, or at latest tomorrow morning. With ES up ten points overnight that’s looking very promising for today, and if this IHS on SPX breaks up the target would be in the 1980-5 area, well over 1955 resistance, and in effect targeting a retest of the highs. SPX 60min chart:

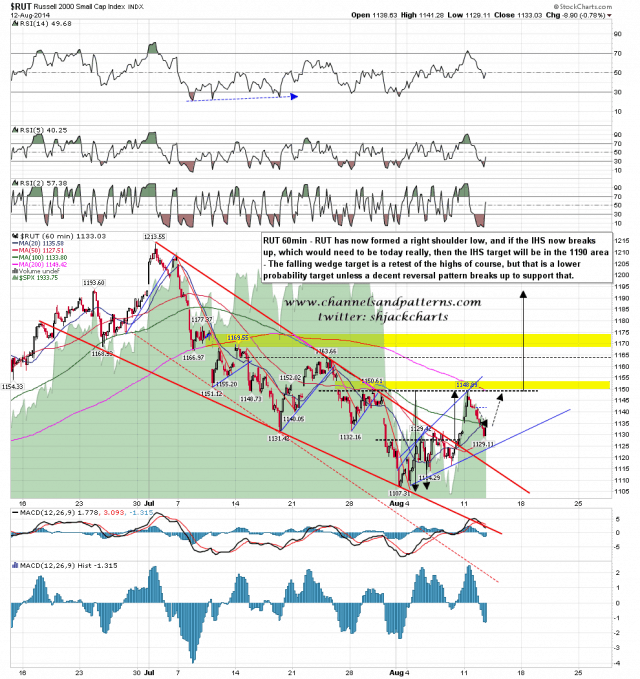

RUT formed a decent right shoulder low and on a decent break over Monday’s highs the IHS target there would be in the 1190 area. As with SPX, if that target is made, the real target is in effect a retest of the current all time highs. RUT 60min chart:

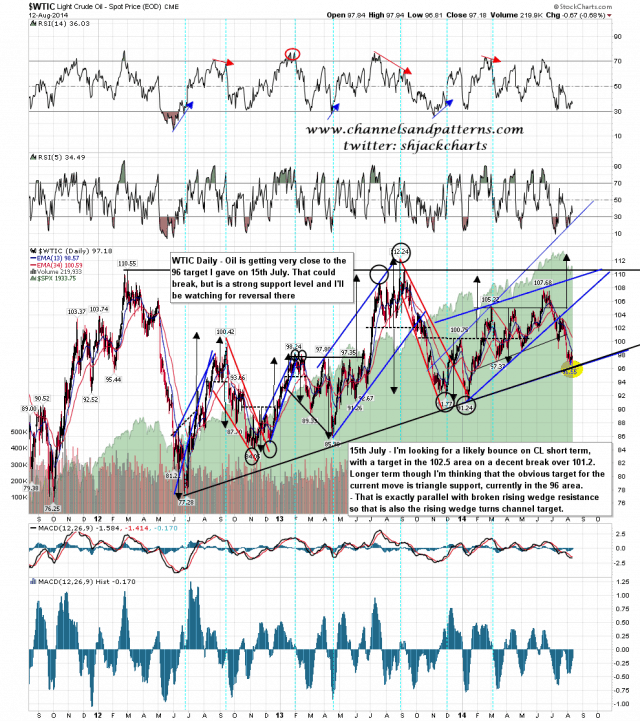

WTIC has been flirting with my 96 area target for a few days now without quite touching it. I have that in the 96 to 96.3 range now and it is very strong trendline support as it is both triangle and (rising wedge turns) channel support. I’m expecting it to hold, but if it breaks it would open up a lot of potential further downside. WTIC daily chart:

Bulls have a very good chance here to take back control of equities for the next few weeks, and I’m expecting that to happen. Main short term support is now back at the 50 hour MA at 1927 and serious resistance at 1955.