I was saying on Friday morning that in all of the three instances since the start of 2014 when SPX broke back below the 5 DMA within two days, then a new low has been made before new highs were made. I had a look further back and that was also true in 2012 and 2013, though in both instances there was one instance that went on to make short term higher highs before those new lows were made.

That’s a concern for bulls here as SPX tested the lows on Friday but did not make a lower low. This low is therefore uncertain and the rally from it may fail, most likely at the open today, the test of the Thursday high, or a test of the daily middle band.

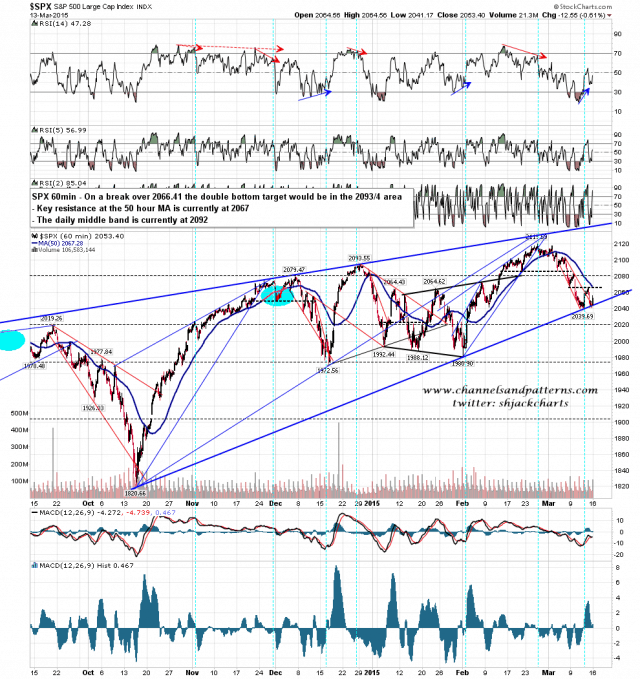

On the SPX 60min chart the rising wedge support trendline from the October low held again, although it’s starting to look somewhat frayed. On a break over Thursday’s high at 2066.41 the double bottom target would be in the 2093/4 area. It’s worth noting that double bottom resistance at 2066.41 is a match with the 50 hour MA at 2067 and the double bottom target is a match with the daily middle band at 2092. SPX 60min chart:

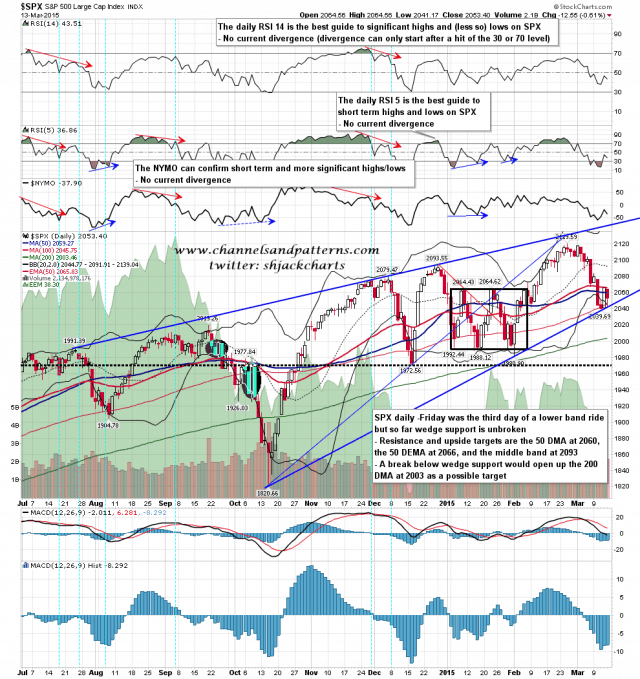

Friday was day three of a daily lower band ride. To make today the fourth day SPX would need to reach the 2036-9 area at some point to test the daily lower band. SPX daily chart:

The setup is pretty straightforward today. Bulls want to beat Thursday’s high to open up a test of the daily middle band. Bears want to take this back down to the lows to test the daily lower band and try to break rising wedge support for the third time. The failure to make a lower low on Friday favors new retracement lows being made before a serious attempt at a test of the all time highs is made.