In the beginning, Facebook connected the world. It brought new hope for humanity and individual, human connections. But the dark, underbelly of the Facebook Beast would be revealed in an unprecedented and extraordinarily jarring manner. A soulless serpent would slither in, unnoticed, and disrupt the otherwise innocent processes, effectively co-opting, undermining and exploiting the intended use of the “gift” Facebook had bestowed upon us, for darker, more nefarious purposes.

Hmmm… that sounds vaguely familiar.

Okay, there’s the requisite melodramatic opening scene that effectively outlines and condenses the evolutionary story and subsequent disruption of the Mother of all Social Media platforms. Fast forward to today, and we have an out of control, unmanageable behemoth of a company, whose right hand still doesn’t know what its left hand is doing. Although, to its credit… it’s trying. But it’s too little, too late. Users are dropping like flies in the haze of a media pest spray discharge. And, distrust of the platform in light of its many convoluted tools and rules, is rampant. Suddenly, the household name of Facebook, has become a household scourge.

However, Facebook continues to espouse the virtues and benefits of its life-changing, relationship-forging platform that started it all. Ah, Facebook… the originator of the great Social Medial Experiment. We were the first. Trust us. We’re trying… really.

But, as a public company, there is a great equalizer: Earnings.

Every quarter, public companies must report their operating metrics in order to comply with SEC rules and provide transparency to, and for, their investors. And the second quarter’s earnings showed that, even though Facebook’s intention and desire to continue as the leader in the social media space was front and center in all of their advertising, those who chose to use Facebook dwindled in great numbers. And, adding insult to injury, Facebook itself fessed up to the fact that it sees fewer users going forward, as well. That won’t bode well for the bottom line.

This prompted analysts to scramble and rethink their positions on the venerable, heretofore bulletproof company. Case in point, Gene Muenster of Loup Ventures, a highly respected analyst said, “Investors should stay away from Facebook for the next quarter.” That was the death knell for Facebook. A 20% drop in share price is a crushing blow for any company, and that is what Facebook experienced in Thursday’s session.

So, what’s next for Facebook? Well, that remains to be seen. They have an enormous amount of work to do to recover from this setback. Will they take it seriously? Well, to some degree they will. But they will also ride on the coattails of their rich entitlement and rely upon the reputation they hope is still intact. Inevitably, they will continue to fight against Fake News and Bots on their platform. They will also attempt to curry favor with their customer base and the powers that be, in order to regain a positive footing.

Lastly, how will this affect other public companies and, more specifically, the stock market? Well, that remains to be seen, but Facebook’s stock has been part of a contingent know as FANG. And, as such, has been a market leader. It’s share price has continued to escalate and has helped the S&P recover from the February 2018 lows and contributed to several new highs in the NASDAQ.

You would think the market would be dependent upon Facebook to re-establish itself and recover its lost market share. Remember, it lost 20% of its share price overnight, after its earnings report. But, in Thursday’s session, it appeared the market had disregarded Facebook’s earnings debacle and decided to focus on other, more important, things. Like, Amazon’s earnings.

So, as we make our way out of earnings season, it’s quizzical to consider Facebook’s exogenously negative earnings report as only minimally affecting the stock market. But here we are, only thirty-five S&P points from the all-time high set back in January of this year. Sure, the NASDAQ took a beating, but with AMZN’s earnings report, it will most likely come back with a flourish and simply dismiss Facebook’s earnings bust.

Is Facebook’s stock a buying opportunity down here? Maybe. But even those who believe in dollar-cost-averaging will think twice before adding Facebook to their portfolios anytime soon. Simply put, there are better opportunities out there right now.

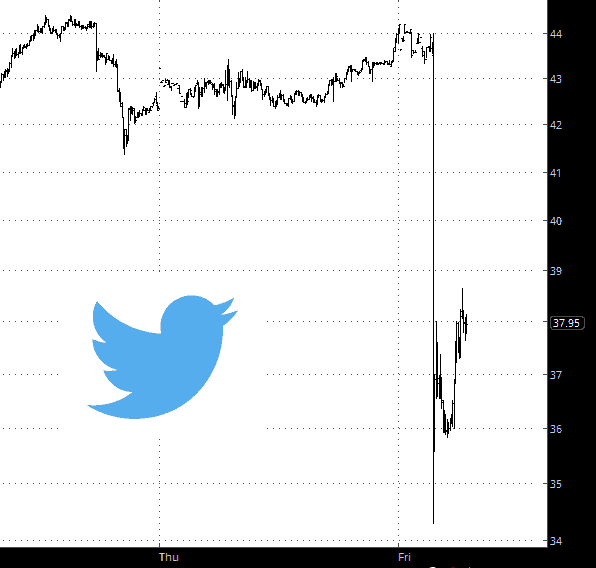

BONUS Chart: This morning’s debacle: