Iced Coffee

I remember it like it was yesterday. It was late in 1992, and the partner in my startup, Prophet Financial Systems, told me excitedly that Palo Alto finally had a “real” coffee shop called Starbucks. I had never heard of it before, but he said it was absolutely incredible and that I should try it.

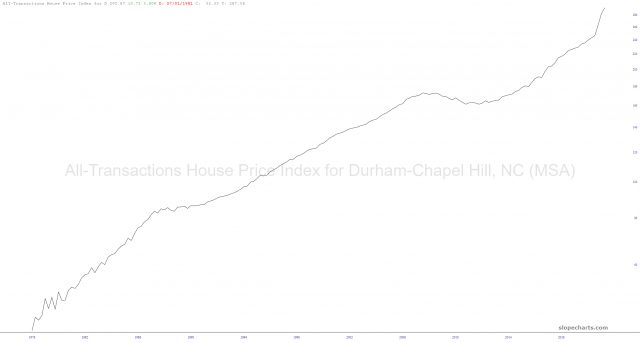

Well, every other storefront in Palo Alto is a coffee shop now, and frankly I’d never even consider going into a SBUX to pick from one of their overly-processed, super-sweet, fat-Americans-pandering “drinks” which are basically 700 calorie desserts in a cup. As a chartist, I simply wanted to point out that the company has broken its long-term trendline and, having lost almost half its value, is illustrative of just how weak the market is now.